All Crypto-Related Business Legalized in Belarus

The Presidential decree, on March 28 “on the development of digital economy” came into force which has finally legalized cryptocurrency activities in the country. The country, according to the reports aims to become a global IT hub which brings various businesses from across the world. Because of the various generous incentives from its newly-enacted decree and unprecedented freedoms, many crypto entrepreneurs are expected to invest in the country.

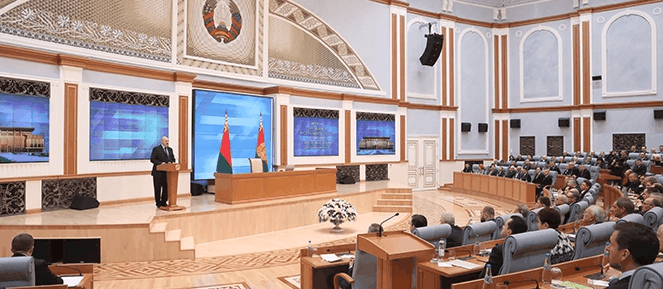

President Alexander Lukashenko signed the decree into law last December which made Belarus the first nation in Europe to offer freedom for all cryptocurrency activities. The new law, however, has legalized every business related to cryptocurrency in the country which includes initial coin offerings (ICOs), exchange services, smart contracts and mining operations.

One of the stated benefits of the presidential decree is that there would not be any imposition of taxes on the activities related to cryptocurrency. Belarus, unlike other countries, has exempted all activities related to cryptocurrency from taxation. Private individuals who trade and mine cryptocurrencies and businesses in Belarus can enjoy various benefits and tax breaks until January 1, 2023. International cryptocurrency firms are also attracted to operate in the tax-free country for the next five years due to this decree.

There has been various adoption and changes of new laws and policies in Belarus due to the Presidential Decree. A crypto accounting standard was adopted last week to help the accounting systems to accommodate cryptocurrency. Changes have also been made by the Central Bank of Belarus in its oversight of financial institutions and commercial banks. The introduction of new requirements for the internal control procedure has also been addressed. The new policies and rules aimed at preventing terrorism financing, illicit incomes, and proliferation of weapon for mass destruction from being legalized. The government is of the view that the measures will assist in strengthening the measures of anti-money laundering and improve cybersecurity in the nation.

Two Japanese Crypto-Exchanges to Shut Down

As regulators tighten oversight of the sector, two more Japanese cryptocurrency market operators are quitting which totals to five exchanges closing until now in the wake of the $533 million hack of Japanese exchange Coincheck in January. Fukuoka-based Mr. Exchange and Tokyo GateWay are withdrawing their application as exchange operators to register with the Financial Services Agency of Japan. On March 8, the FSA ordered both to improve the security of data and other safeguards after they were found to be lacking.

After returning the cryptocurrency holdings and cash of the clients, the companies will leave the exchange business. All cryptocurrency exchange operators are required to register with FSA as per the law which took effect last April. So far, sixteen exchanges have done the same and another 16 were permitted to operate until their applications were under review. All the five exchanges which have decided to abandon the business belong to the latter group, similar to Coincheck from which about $532 million or 58 billion yen at that time was stolen in virtual currency NEM in January.

[The news isn’t all bad, TCF is giving away a free Ledger Nano S to 2 lucky winners on April 6, 2018. Enter here.}

The FSA began on-site inspections after that of all 16 unregistered operators with pending applications. It was required by these exchange operators to have data security and other systems on par with those placed at the registered exchanges. However, the probe by FSA so far has found issues with internal controls and corporate governance. There are other three unregistered operators based in Japan who have withdrawn their applications to register, namely, bitExpress, Raimu, and Bit Station. As the FSA has given several exchanges a chance voluntarily close before ordering them to do so, more are expected to follow.

{The crypto markets can swing quickly, as you can see by comparing our Feb news to today’s update.}

Merchants of South Korea see the option of Crypto Payment by 2019

Consumers of South Korea are set to get access to a larger amount of shopping options wherein they can spend their cryptocurrency. Bithumb, South Korean exchange has announced its plans to open the platform and allow the users to utilize cryptocurrencies at more than 8,000 stores by the end of this year. In June, the exchange is expected to start offering a pilot program, and throughout the rest of the year roll out the service to additional merchants.

The firm is said to be teaming up with a digital payment provider in the country named Korea Pay. Currently, Korea Pay generates around $279 million and handles transactions for over 200 brick-and-mortar stores each year. Consumers will be able to easily pay using their cryptocurrency wallet in stores such as Sulbing and Yankee Candle.

The announcement comes after a lot of popular exchanges made the similar move during last month. The firm, for the installation of cryptocurrency payment machines, has already partnered with a number of restaurants and cafes so that those establishments could accept crypto from their customers. The payment kiosks were a joint effort of Bithumb and kiosk manufacturers like IYU, Tros Systems, and Unos Space.

In addition, Bithumb has also entered into an agreement with a South Korean travel website that centers on hotels and vacation rentals named Innovation Corp. Bithumb user can now pay for their stay with any of 12 supported cryptocurrencies as the website hosts more than 50,000 different lodging opportunities. Among all exchanges, Bithumb is currently ranked sixth in trading volume.

A Softer Approach of UK towards Digital Assets

Following the publication of Financial Stability Board (FSB) letter with positive statements from Mark Carney, British politicians demonstrate softened approach towards cryptocurrencies. John Glen, Britain’s City minister is sure that virtual money will not have any harmful impact on the economy of the UK but believes that adequate regulation is necessary. He said on the sidelines of the Treasury’s International Fintech conference on Thursday that “We are seeing great excitement, some wariness, and also I think some misunderstandings. We remain agnostic and are engaged in trying to find the right narrative and the right level of regulation if that’s appropriate,”

He also added that “The issue is, how do we regulate or not, how do we enable or not, based on the blend of opportunities and risks that may exist in this new technology.” British Chancellor of Exchequer, Philip Hammond set up a special task force to evaluate both benefits and risks of blockchain technologies and digital assets with an aim to attract fintech companies to London’s City and foster innovation. The largest exchanges at present are concentrated in US and Asia while the UK lags behind. If one of the major players of the financial universe extends a more friendly approach towards crypto, it might change the situation and force other regulators to soften their stance.

{US tax return deadline is fast approaching. Need help? Start here.}

Tom Lee sees Bitcoin at $25,000 by the end of 2018

Tom Lee, founder of Fundstrat and famous crypto proponent comes out again to tell people that bulls will have the upper hand. Despite the fact that Bitcoin has been moving in a bearish trend since the middle of December 2017, he maintains the year-end target of $25,000. Tom Lee, a former chief equity strategist at JPMorgan Chase & Co drew parallels with equity market, where investors need to be patient to live through the bearish trend and stay on positive balance in the end.

Lee argues that just as the top equity indices, Bitcoin on an average see most of its gains only during a few days each year. Hence, it is preferable to buy and hold and not to miss out this handful of winning days. Lee said in the interview with CNBC last week said “Long-time holders are worried because they have big gains and they’re worried about falling prices. But bitcoin is a great store value. It works really well. It’s kind of boring, because it’s not the latest and most exciting project. But it also is one of the most liquid ways to get exposure to crypto.”

The Cryptocurrency Forums is growing in 2018. Register for a free account using this link and join the discussions. No email marketing, spam or newsletters.

Join our discussion on this market downturn in our latest forum thread on crypto markets.