Many cryptocurrency investors were caught off guard when the 2018 tax plan was passed into law. One of the provisions of the new plan clarifies that section 1031 like-kind exchange transactions are limited to only real property, items like cars, trucks, buildings, land, etc. In other words, the IRS shut down any possibility of using like-kind exchange rules to defer paying taxes on cryptocurrency gains for trades made between other cryptocurrencies.

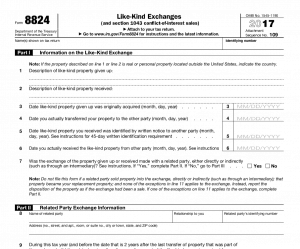

Until December 2017, opinions varied on how to report crypto to crypto trades for tax determination. Some advised to treat gains just like stocks, precious metals, and other investment classes. In other words, every trade is reportable. Some authors have written that they believe like-kind exchanges applied to crypto trades before the current clarification was released. However, even assuming this to be the case, traders are required to report 1031 like-kind exchanges with each annual tax filing using form 8824.

One major potential downside of attempting the like-kind exchange route to defer paying capital gains taxes in 2017 or earlier years is that you will still be reporting your holdings and trades thus making the IRS aware that you own and/or trade crypto. If a future ruling disallows this, you will be on the hook for tax due plus penalties and interest.

The safest route with the IRS is to always assume you cannot do something unless they specifically allow it. In other words, since they made no statement at all regarding cryptocurrency and like-kind exchanges before December 2017 ruling, it is unlikely they intended to allow it.

Register for a free no spam account here.

How do I report crypto to crypto trades?

The biggest issue facing cryptocurrency traders and investors is accurately determining the US dollar value of crypto to crypto trades. In the best scenario, you would record each trade at the time of execution, either within your own record-keeping system or spreadsheet or using one of the popular online tools such as Blockfolio, CoinTracking.info or Bitcoin.tax. You can also download your exchange reports and enter all of your trade history into tracking tools.

But what about those of you who have trades that you didn’t document at the time? What if you don’t want to enter your information on a tracking site? Or maybe you just want to review the info from the tax sites before filing. No worries, you can use your downloaded exchange reports to accurately determine the value of the trades on the specific date and time they were executed.

{The market drop in 2018 Q1 shook up crypto traders. Long-term investors may end up faring better. Patience is important when investing.}

Start with your exchange reports

Download reports from all of your exchange accounts and have them ready to use when preparing your crypto trade tax reports. There are numerous tools, charts and reports available in your exchange accounts. You should take time to familiarize yourself with some of the more common reports, since you should be regularly evaluating your portfolio gains and losses to decide when to buy, sell or rebalance. Some users import their exchange reports into the online tools or into an Excel spreadsheet for record-keeping and analysis.

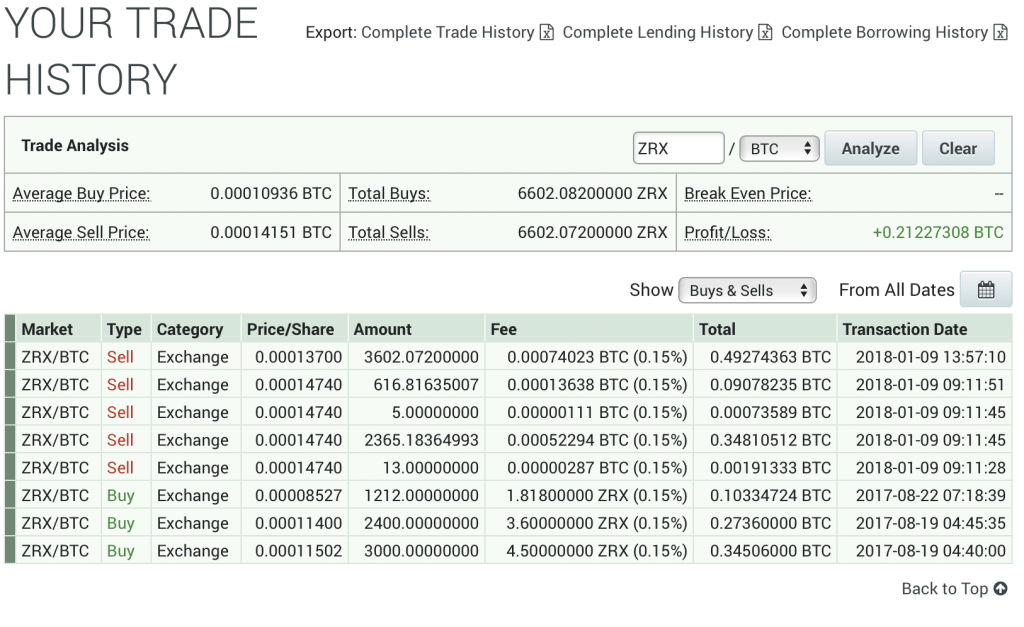

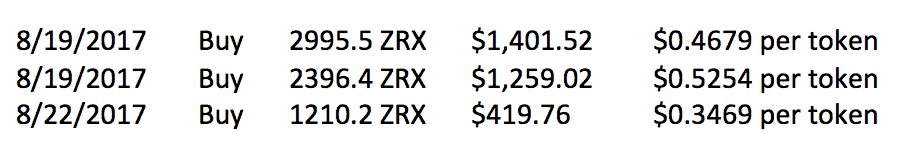

Let’s start with a sample exchange report for 0x token (ZRX) buys and sells (fig. 2.) Note that the sells occurred in 2018, they don’t apply to 2017 taxes. Trades are reported in the calendar year executed for tax purposes. However, we are focused on the bitcoin (BTC) to ZRX transactions in August 2017.

Bitcoin to altcoin trades are bitcoin sales

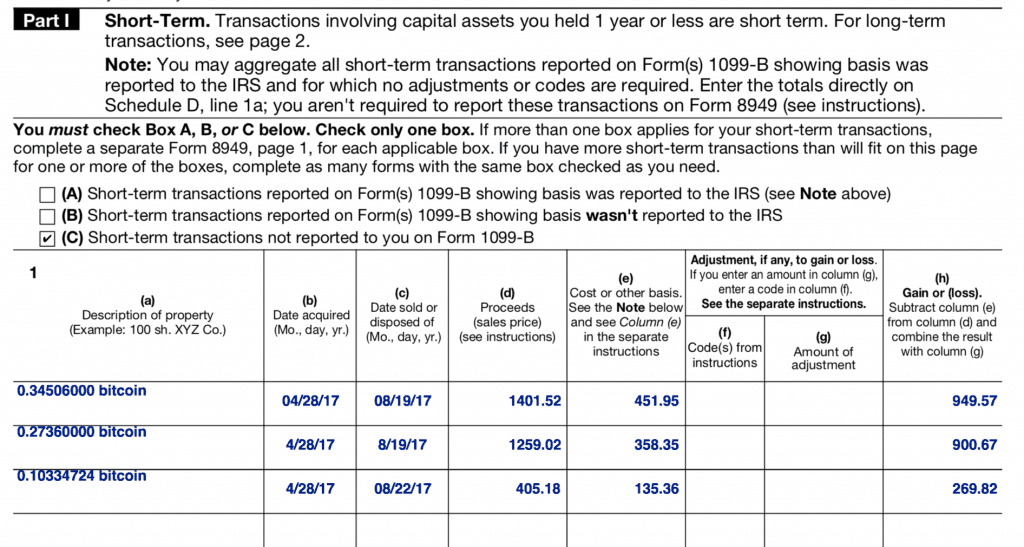

Why are we discussing the BTC to ZRX buys? For the purposes of tax reporting, those are treated as BTC sales occurring on the date and time of the trade. For example, the earliest transaction involved buying 2995.5 ZRX tokens (4.5 ZRX fee taken) with 0.3450600 BTC. That trade should be reported on form 8949 in the same fashion as discussed in our crypto to fiat tax article.

Let’s work through that trade. The first bit of information you will need is the exchange report from the purchase of that amount of BTC. It may have been as a single purchase that you then used in entirety to swap for ZRX. In that case, look up and record your total cost of that bitcoin before the next step.

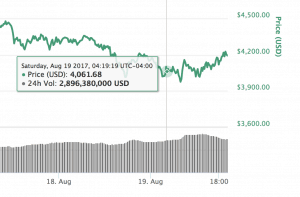

Ideally, you would have a record of the US dollar value of the first August 19 trade in your record system. If not, no worries. Simply navigate to your preferred crypto charting tool and look up bitcoin value at the time of that trade. I prefer Coin Market Cap (CMC.)

As you can see from figure 3 above, bitcoin average price from exchanges on Saturday August 19, 2017 at 04:19 UTC was $4,061.68. This means that we “sold” 0.34506000 BTC for $1,401.52 and then used that same $1,401.52 to buy those 2995.5 ZRX tokens. You can watch this quick video clip of navigating through Coin Market Cap screens to get historical prices.

https://youtu.be/r1frjluXUn4

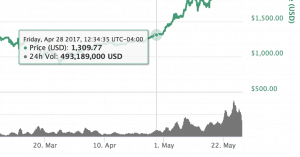

In order to report that trade, we need the cost basis of the amount of bitcoin exchanged for the ZRX tokens. Let’s assume we purchased 1.0 BTC on April 28, 2017 at $1,309.77 on GDAX without trading fees. That would give our 0.3450600 BTC a cost basis of $451.95. The result of buying ZRX is a taxable gain of $949.57 in bitcoin.

Revisiting form 8949 for crypto to crypto trades

Using the information from the previous paragraphs, you now need to report this trade on IRS form 8949 as covered in our companion article. All 3 purchases of ZRX from figure 2 are listed as bitcoin sales on form 8949 using bitcoin prices on day and time of each trade. Crypto price quotes on all tracking sites are averages of trading price on different exchanges, and there are quote delays. It is not possible to be precise to the minute when estimating crypto to crypto trades. The IRS will accept a best estimate method for determining trade prices. The first 2 trades were only a few minutes apart. BTC price for the final ZRX buy was $3,957.20 on CMC.

You will note that we’ve now “sold” 0.72200724 of our 1.0 BTC purchase. We have 0.27799276 BTC remaining from that buy. We have a total realized gain from those 3 ZRX buys of $2,120.06.

Determining cost basis in crypto to crypto trades

You may be wondering how to treat the purchased ZRX tokens from the above trades. Each separate ZRX trade is assigned the cost basis of the bitcoin value at the time of the trade. In the examples above, we have the following 3 trades in the records to use when exchanging ZRX back to bitcoin:

Note that each buy has a different cost basis. Mutual fund buyers have the option to use different cost basis methods, including average cost. That method is unique to mutual funds per the IRS, it can’t be used for stocks or securities, and it’s unlikely that crypto investors can use it. Refer to our other tax articles for discussion of the FIFO, LIFO, and Selected Lots accounting methods.

Be sure to register for a free account at this link.

Keep up with the latest tax discussions in this thread on our forums.

This is the final installment of our 2017 tax series. Most of what we’ve covered over the last several months will be useful in 2018, but readers should always keep up with the latest tax regulations and consult with an expert when needed. Thanks for reading.