Technology has changed how we pay for things. Physical things like cash, checks, and credit cards are becoming outdated as we can now pay for groceries, eat at restaurants, or buy clothes by merely waving our phones or watches in front of electronic readers, or we can pre-pay for them through apps. Now, there is a new way with which we can pay for things – and it is called cryptocurrency, or crypto.

What is cryptocurrency, how does it work, and why does it matter? Simply put, cryptocurrency is digital money that is secured by sophisticated software. It can be used to purchase things, pay for services, or settle a debt. Crypto can also be bought as a short- or long-term investment. Lastly, as we are about to see, cryptocurrency may very well change the way global commerce works.

Perhaps you are a long-term investor looking for a worthwhile asset or a short-term speculator eyeing the unpredictability of cryptocurrencies around the world to pocket a potentially large profit. Maybe you are a consumer who is fed up with the excessive fees and poor customer service that are often associated with big banks. Either way, consider this article your Cryptocurrency 101. (Register for a free forums account and join the discussion)

What is Cryptocurrency?

We have all heard about it, but what exactly is cryptocurrency? In basic terms, cryptocurrency is a digital or virtual medium of exchange used to purchase goods or services. Cryptocurrency can also be considered an asset to be held with the expectation that it will retain or increase its value, or it can be viewed as an investment with the hope of a profitable return.

The number of cryptocurrencies continues to grow exponentially, and definitions of what is and is not cryptocurrency vary from source to source. However, certain attributes are widely accepted. Regardless of the cryptocurrency, individual units are referred to as coins or tokens, and ownership of specific crypto can be broken down into fractional amounts (e.g., 1/2, 1/3, 1/4 and smaller, but usually referred in decimal math as 0.5, 0.333, 0.25, etc. Most currencies can be owned in increments as small 10 to the minus 8th power, or 0.00000001, with the potential to be expand to 16 decimal points later if needed.

These are the essential characteristics of cryptocurrency:

- By its very nature, cryptocurrency is a decentralized financial system that lacks a central governing authority creating, issuing, and enforcing policies. Instead, crypto operates on a peer-to-peer platform, a vast network of computers equally responsible for maintaining a distributed data structure that primarily serves as a communal ledger of every transaction.

This decentralized feature is the signature aspect of cryptocurrency and the inspiration behind its creation. There is no government or large corporation behind cryptocurrency using the virtual money to further its own goals and purposes. In theory, crypto is immune to internal corruption and acts that go against the interests of the masses.

- Cryptocurrency relies upon strong cryptography for the security of its entire network because it exists in a digital space. Unlike banks, credit cards, or other financial institutions that operate on a central authority model, crypto does not have an internal decision-making body governing its policies and policing its transactions.

Powerful encryption programs are used to confirm all transactions, verify ownership and transfers of ownership, and to create new cryptocurrency units. They also ensure that the crypto is trustworthy by accurately accounting for every single coin and preventing double-spending.

- Much of cryptocurrency’s decentralized nature is achieved through a type of data structure known as a blockchain. Because cryptocurrency is based on a decentralization model, there is no central authority regulating and validating transactions and enforcing rules and policies.

Instead, these responsibilities are carried out by the collective efforts of a vast peer-to-peer network that validates every transaction that occurs on a cryptocurrency network. Each group of confirmed transactions is known as a block and contains information such as the parties that were involved, the date and time of the transaction, the amounts, and so on.

A blockchain gets its name from the way that each completed transaction is recorded to the end of an immense string of entries, with each block cryptographically linked to the previous block. Because no block can be changed without also modifying every single block that was recorded afterward, a blockchain is a strong, reliable, and unalterable data platform. Or as they say, it’s decentralized, encrypted and immutable ledger of records. A blockchain needs a token or currency to execute its protocols.

- Since cryptocurrency is a virtual medium, each account holder must have a digital wallet through which units can be safely held, into which additional units can be received and from which transactions can be paid. Crypto wallets, as they are commonly called, are no more than sophisticated software that interacts with one or more cryptocurrency exchanges.

To maintain security in conducting all transactions, each wallet typically has two “keys” (also referred to as “addresses”) associated with it:

- A public key that essentially allows other account holders to transfer units to the wallet’s address via a publicly known data string that is unique to the wallet and works like a bank account number.

- A private key that works like an ATM pin code and must be used to transfer units out of the wallet’s address. The private key must be safeguarded against accidental disclosure and should be kept private the same way that you would protect your social security number.

If you are looking for advice on how to get started investing in bitcoin, we’ve got you covered in our Easy Ways to buy Bitcoin post.

Validation of Cryptocurrency Transactions – The Two Competing Models

Peer validation is the backbone of cryptocurrency, representing how each transaction is verified and added to the network’s communal ledger. It also plays a vital role in the actual creation and allocation of new crypto units in specific systems, namely Bitcoin mining. The two primary crypto validation systems are (1) proof of work and (2) proof of stake.

The Proof of Work Model

Several of the more established cryptocurrencies, including the crypto pioneer Bitcoin, utilize proof of work as their validation systems. Often referred to as mining, this adaption of proof of work validation pits miners (individuals, groups, enterprises) against each other in a global race to be the first to solve complex mathematical equations and earn the right to validate a particular transaction block. Successful miners are rewarded for their success and compensated for their efforts by earning coins or tokens of the cryptocurrency that they validate. In the case of Bitcoin, the current reward for successfully adding a single block to the blockchain is 12.5 bitcoin, which, based on a recent closing price of around $6,000 per bitcoin, would be worth $75,000 to the bitcoin miner. Plus all the transfer fees associated with that block of transactions.

As the bitcoin network progresses, the difficulty of mining adjusts based on network demand and preset changes programmed into its blockchain protocol. The reward for mining is expected to be cut in half sometime around May 2020, and this has occurred several times in the past. It will also happen later at a time when the number of transactions reaches the next specified level. This is called a halving. After that, miners will receive 6.25 bitcoins per block confirmed.

Cryptocurrency Mining

On the surface, cryptocurrency mining appears to be a highly profitable enterprise, but it is incredibly competitive. In recent years, participants have been forced to invest huge sums toward expensive, highly specialized computing hardware to solve increasingly tricky equations and to stay competitive with their peers around the world.

Aside from the massive amount of capital needed to acquire the necessary hardware and the frequent upgrades, there is also the matter of paying for the tremendous amount of electricity that this computing equipment consumes continuously. It is widely speculated that the most extensive bitcoin mining operations, which can occupy a whole warehouse, consume as much electricity as small countries.

This is being addressed, however, and bitcoin developers hope to decrease the electrical demands of the network eventually. In addition, equations that calculated bitcoin’s electrical impact often ignore that the entire world banking system is also using considerable electrical power to run their systems, so bitcoin’s impact on the environment is lessened if it replaces traditional banking systems.

The Proof of Stake Model

Where cryptocurrencies operating on a proof of work model are referred to as mined cryptocurrencies, those that operate on a proof of stake model are known as non-mined cryptocurrencies. Instead of relying on a winner-takes-all, competition approach to validating blocks of transactions, proof of stake rewards ownership of a cryptocurrency with opportunities to proof transactions.

Typically, proof of stake cryptocurrencies afford more significant stakeholders greater opportunity to validate transactions. To protect smaller stakeholders and to safeguard against the complete monopolization of the validation process by more prominent owners, the selection process is somewhat randomized. But clearly, the more coin you own, the better your chances of being selected to proof transactions.

One of the biggest differences between proof of work and proof of stake is the reward itself. Instead of being compensated with actual crypto units, stakeholders in proof of stake are rewarded with the total transaction fees associated with a block of transactions. While this value is certainly much less than cryptocurrency, the actual costs of participating in this validation method are also significantly less.

Proof of Work vs. Proof of Stake Cryptocurrencies

Now that you have a better understanding of proof of work and proof of stake, here is a breakdown of the major players in the world of cryptocurrency and the validation method used by each of them:

| NAME OF CRYPTOCURRENCY | PROOF OF WORK | PROOF OF STAKE |

| Bitcoin | X | |

| Cardano | x | |

| EOS | X | |

| Ethereum | X | |

| Litecoin | x | |

| Monero | X | |

| NEO | X | |

| Ripple | X | |

| Stellar | X |

The 51% Problem

Both proof of work and proof of stake cryptocurrencies are potentially vulnerable to hostile takeovers if most of their players worked together. In the case of proof of work cryptocurrencies, in the highly unlikely event that an alliance of miners representing 51% (more than half) of an entire crypto network’s computing power was to act in unison, it could theoretically hold the network hostage.

For large, well-established, mined cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and the like, a hostile takeover is virtually impossible because of the sheer scale of their networks; for small, lesser developed crypto networks, however, this threat is unfortunately very real.

For proof of stake networks, the hostile takeover scenario plays out if 51% of all issued coins or tokens were to fall under the control of a single entity. Under these circumstances, however unlikely, the cryptocurrency network and its stakeholders would find themselves taken hostage and mostly defenseless. Again, the smaller, lower capitalized systems are the ones potentially at risk of takeover.

How do You Acquire Cryptocurrency?

Cryptocurrency is unique because it has characteristics of paper currency, a medium of exchange, and a commodity. As such, there are a variety of channels and methods through which it can be acquired. Although private party exchanges are undoubtedly possible and do occur, most cryptocurrency transactions occur on established online portals.

Coin Exchanges

As cryptocurrency becomes increasingly popular to investors, speculators, and consumers alike, so have the number of online cryptocurrency exchanges grown in recent years. The format of these exchanges varies, ranging from traditional middle-man type platforms that offer benefits and protections often found in centralized systems to peer-to-peer communities that operate with less formality but higher risk.

Some P2P exchanges are scams; you send money and never get bitcoin. Here at TCF, we endorse Coinbase as the #1 place for getting started. It is safe, legal, approved by governments, recognized by almost all banks, and makes buying and selling easy. All of the following are legitimate places to buy and sell. None are scams.

Here are some of the most popular cryptocurrency exchanges:

- Coinbase – This is one of the world’s largest crypto exchanges where people can buy, sell, store, and trade cryptocurrencies. Although the number of cryptocurrencies is somewhat limited, Coinbase has a reputation for working with regulators, which gives traders some peace of mind. It also has the easiest user interface, which is important because trading mistakes on the other exchanges can be costly. Fees on Coinbase are high due this convenience factor. Switching to Coinbase Pro can save quite a bit.

- Gemini – This is another exchange that is known for working with regulators and promoting transparency. Its U.S. dollar reserves are held in FDIC insured banks. Fees will be similar to Coinbase Pro and cheaper than Coinbase.

- Binance – By many estimates, this is the world’s largest crypto exchange, and it even has its own cryptocurrency, the Binance Coin, which, if used on this exchange, will get you reduced transaction fees. Regular fees are also cheaper than Coinbase.

- Kraken – Founded in 2011, this is one of the oldest cryptocurrency exchanges in the United States. Among its peace-of-mind benefits is its proof-of-reserves auditing. And like the others above, fees are less than Coinbase.

- Coinmama – This is one of the oldest crypto exchanges with a traditional, old-school approach that still appeals to many crypto traders. It is highly trusted and user-friendly for beginners.

Perhaps because of the unpredictability and novelty of cryptocurrency, blueblood investment firms and trading houses have resisted the temptation to join in the crypto craze. However, several traditional stock brokerage firms, including Fidelity, Sofi, and other houses, have announced plans to offer cryptocurrency-related services and support cryptocurrency trading soon.

And you can own a few cryptocurrencies by proxy in the Grayscale Investment funds. I hold a few shares of bitcoin and Ethereum in my retirement account in this fashion. They trade like ETF’s although they aren’t yet classified as such. They often are priced at a premium to the amount of the underlying crypto they own, because they are the only player in this market, which is a downside. Hopefully governments will eventually approve a true cryptocurrency ETF that’s easily available via all brokerages.

Other Cryptocurrency Platforms

There are several different ways to invest in cryptocurrency or to own it outright. Specific cryptocurrencies, namely Bitcoin, can be purchased and even sold, through a network of ATMs (approximately 3,000 in the United States alone). Various funds are traded over the counter that holds positions in cryptocurrencies, although these are typically priced at a premium.

Of course, as previously discussed, yet another way that cryptocurrency can be acquired (in the case of proof of work crypto) is through mining.

What are the Different Types of Cryptocurrencies?

We have reviewed the defining characteristics of cryptocurrencies and taken a close look at the two primary operating models for cryptocurrency networks: proof of work and proof of stake. Next, you will learn about the major players in the expanding world of cryptocurrency, beginning with the one that started it all – Bitcoin.

Bitcoin

Bitcoin was formally launched in 2009 with the release of its open-source software and the mining of its genesis coin. Bitcoin was founded by an individual or group operating under the fictitious name Satoshi Nakamoto. Although theories abound as to Satoshi Nakamoto’s identity or identities, thus far, all efforts to unveil the person(s) behind the pseudonym have been unsuccessful.

As the first truly decentralized cryptocurrency, Bitcoin has served as a model for the thousands of cryptocurrencies that have been launched, many unsuccessfully, since its arrival. Bitcoin is credited with successfully implementing a viable and sustainable blockchain network and proof of work model for cryptocurrency, with far-reaching applications that go beyond crypto.

The transparency afforded by blockchain methodology, along with its heightened security aspects, has been contemplated by industries ranging from healthcare, legal professions, and even traditional finance.

Interesting Facts About Bitcoin

Aside from the mystery surrounding the identity of its founder(s), there are other interesting aspects of the Bitcoin story.

- The total number of coins that can ever be mined has been predetermined to be 21 million; based on the 18 million bitcoin in circulation, this leaves an unmined inventory of 3 million, the very last of which is estimated to be mined in the year 2140.

- As more and more blocks of transactions are validated and added to the blockchain, the block reward gradually decreases (it halves after every 210,000 blocks or roughly every four years). From the current 12.5 bitcoin that miners receive for proofing transactions, the reward will decrease to 6.25 sometime later in 2020, then 3.125 four years later, and so on.

- Just as the U.S. dollar has smaller denominations with the smallest being a penny ($0.01), so does the bitcoin. The smallest denomination recognized on the bitcoin blockchain is the Satoshi, which is 1/100,000,000 (one one-hundred millionth) of a bitcoin. Put another way, there are 100 million Satoshis in a single bitcoin, which allows rewards to be shared among mining pools.

Other In-Demand Cryptocurrencies

The success, buzz, and intrigue generated by Bitcoin have spawned thousands of cryptocurrencies in the 11 years since the first bitcoin was mined in 2009. Although many crypto ventures have failed, some in rather spectacular fashion, there are remarkable success stories as well.

Many attributes contribute to a cryptocurrency’s success, longevity, and global impact. Market capitalization alone is only one indicator, albeit a significant one, of a crypto’s viability or sustainability as a digital currency in this competitive field.

Here are a few noteworthy cryptocurrencies that aim to follow in Bitcoin’s footsteps:

- Ethereum (ETH) – Touted as Bitcoin’s strongest competitor, Ethereum is fundamentally different in that Bitcoin is strictly a digital currency, and Ethereum is an open-source digital software and processing platform. Its unique blockchain enables users to utilize self-executing smart contract features for a broad range of applications.

Unlike Bitcoin, there is no hard, pre-set cap on the number of coins in circulation, and Ethereum pioneered the concept of the initial coin offering (ICO) through which it pre-sold its digital currency, known as Ether. Ethereum also boasts much faster transaction validation times than Bitcoin, with miners earning five new Ether every 14-15 seconds for each block they proof.

- Ripple (XRP) – Geared toward banks and financial institutions, Ripple is a digital settlement and remittance network specializing in facilitating transactions across borders with its XRP cryptocurrency as the medium. Ripple’s lightning-fast validation (5 seconds versus 10 minutes for Bitcoin), lower transaction costs, and real-time ledger updates are among its chief benefits.

- Litecoin (LTC) – Operating under a similar blockchain validation and mining model as Bitcoin, Litecoin may be more appealing to miners because of its 2 ½ minute block validation time and the fact that mining can be performed with a conventional PC. Litecoin’s LTC is hard capped at 84 million, and like Bitcoin, block rewards are periodically halved.

- Tether (USDT) – To minimize potential volatility, Tether purports to back, or tether, each coin to fiat currency such as the U.S. dollar. This controversial claim has been challenged recently with calls for Tether to open its books to prove that it has sufficient cash reserves to back its digital currency. Tether remains a top-ten cryptocurrency by market capitalization.

- EOS (EOS) – Modeled after Ethereum to offer a digital platform for the development of decentralized (blockchain) applications that are scalable to a wide range of needs, EOS enjoyed one of the most successful ICOs in cryptocurrency history. EOS tokens are not mined in the traditional sense; validators of blocks are rewarded according to their production rate.

- Binance Coin (BNB) – This is the official namesake digital token of the Binance cryptocurrency exchange. The Binance coin facilitates the trading of various cryptocurrencies on one of the busiest cryptocurrency exchanges worldwide, and its users receive discounts on transaction fees using this native token on the Binance exchange.

- Monero (XMR) – Perhaps the most protective of all cryptocurrencies (read more about anonymous cryptocurrencies) when it comes to complete privacy, Monero employs highly sophisticated cryptographic methods to make transactions on its network virtually untraceable. While praised by those in the cryptographic community, Monero has earned a reputation for servicing or facilitating international criminal activities.

These are but a sampling of the thousands of cryptocurrencies currently trading around the world. Some, like the ones described above, are more well-known or in-demand for one reason or another, while others lie in obscurity either through fault or by design.

How Does Cryptocurrency Gain and Lose Value?

The rapid growth of cryptocurrency markets harkens back to the dot.com boom several decades ago, but the rewards are even more extensive and the ventures seemingly riskier. You need look no further than the gold standard of cryptocurrency, Bitcoin, to see the rollercoaster ride in value and to appreciate the extreme difficulty of forecasting growth and profitability both in the short and long-terms.

Bitcoin has hovered between $6,000- $10,000 per coin thus far in 2020 after a rollercoaster 2019 that saw its value peak at $12,500.00 during the summer 2019 and then settle around $7,200.00 to close out the year. At its height in late 2017, Bitcoin reached nearly $20,000.00 per token before plummeting to below $3,500.00 in early 2019. All of which goes to show that investing in crypto is not for the faint of heart.

The total market capitalization of all cryptocurrencies is approximately 175 billion dollars, with bitcoin accounting for 65% of that at the end of March 2020 (check for 24/7 updates on CoinMarketCap.) These are the ten highest valued cryptocurrencies listed in order of their total market capitalization (number of circulating coins times the price per coin) as of February 24, 2020:

| NAME | SYMBOL | MARKET CAP (as of 2/24/20) | PRICE (USD – as of 2/24/20) | IN CIRCULATION (as of 2/24/20) |

| Bitcoin | BTC | $175,338,957,030 | $9,615.00 | 18,235,987 BTC |

| Ethereum | ETH | $28,853,107,034 | $262.68 | 109,841,629 ETH |

| XRP | XRP | $11,795,887,750 | $0.269624 | 43,749,413,421 XRP * |

| Bitcoin CashL | BCH | $6,806,954,431 | $372.02 | 18,297,300 BCH |

| Bitcoin SV | BSV | $5,003,345,587 | $273.49 | 18,294,415 BSV |

| Litecoin | LTC | $4,791,062,867 | $74.68 | 64,157,550 LTC |

| Tether | USDT | $4,651,957,889 | $1.00 | 4,642,367,414 USDT * |

| EOS | EOS | $3,895,049,005 | $4.08 | 954,485,435 EOS * |

| Binance Coin | BNB | $3,378,268,207 | $21.72 | 155,536,713 BNB * |

| Tezos | XTZ | $2,144,952,093 | $3.06 | 701,856,920 XTZ * |

* Non-mineable cryptocurrency

Factors That Influence Cryptocurrency Value

Unlike corporate stocks, bonds, or even traditional fiat currencies, cryptocurrency is not issued by a central authority such as a publicly-traded corporation or backed by a government. As such, the conventional tools used by stock analysts to forecast or predict a stock’s performance are virtually meaningless in the realm of cryptocurrency.

Part of the appeal of cryptocurrency is its decentralized nature, the lack of a central authority manipulating procedures, and enforcing self-serving policies. The policing of the crypto network is entrusted to complex mathematics, ingenious programming, and peer-to-peer validation methods.

Even though it can be said with certainty that cryptocurrency is here to stay, it is still evolving, and its boundaries are still fluid. As such, the science of finding reliable indicators is an inexact one at best.

The following are key factors that can influence the value of cryptocurrency:

- Supply and demand – The price for a cryptocurrency can be driven up if the demand for its coins outpaces supply, such as the rate at which blocks are mined and new coins created and circulated. Some cryptocurrencies are hard-capped with a pre-set maximum number of tokens that will ever be introduced.

- Decreasing rewards – For cryptocurrencies that employ a declining reward system for miners, the decreasing financial incentive together with greater competition can artificially inflate value by further slowing down the rate at which new coins or tokens are introduced into circulation.

- Competition – Since Bitcoin’s launch in 2009, over 5,000 cryptocurrencies have tested the virtual currency waters. As new cryptocurrencies launch ICOs and offer more innovation by way of features and services, the increased competition may squeeze certain players out of the market or drive prices down as consumers have more purchasing options before them.

- Utility and needed market capitalizations for transactions – The theory is that any cryptocurrency adopted for real world use will have to have enough value in circulation to be able to handle the trillions of dollars spent or transferred daily. If a currency manages to become the dominant player, then its value will likely soar in order to significantly stabilize at a point where it can handle the needs of the world’s transactions. A total market value of even $100 billion isn’t enough to handle a day’s worth of transfers and purchases. In the US alone, $4 trillion was spent using credit cards in 2018. If a cryptocurrency became a major player, it’s price would soar to much higher levels to have enough value to handle this financial load.

On the other hand, underperformance by once-promising crypto start-ups may end up boosting the fortunes of more established cryptocurrencies that were able to weather the storm of newcomers entering the ring.

- Investor fear – The threat of online theft of virtual assets by hackers is all too real in the world of cryptocurrency. Several highly publicized events rocked the cryptocurrency world and shook investor confidence resulting in significant depreciation, such as:

Mt. Gox Bankruptcy

In February 2014, a cryptocurrency exchange named Mr. Gox fell victim to a massive malicious attack that resulted in the loss of 850,000 bitcoins (at the time representing over 6% of the world’s bitcoin circulation).

Youbit Bankruptcy

In December 2017, another cryptocurrency exchange operating under the name Youbit was hacked and lost 17% of its digital assets in the process.

While blockchain technology and peer-to-peer networking pose stiff challenges to cyber thieves, as these events have shown, even cryptographically-based currencies are targets given their high value, and on occasion, the hackers do win.

- Negative publicity – One of the hallmark attributes of cryptocurrency is the privacy attached to each transaction, and it comes as no surprise that there is a widespread perception that crypto caters to criminal interests. In October 2013, the FBI shut down an online black market called Silk Road, as it was revealed that drug transactions were being funded via Bitcoin. Crypto values dropped as a result.

- High-profile software glitches and failures – Cryptocurrency depends on its software code for viability and to maintain the value trajectory of its coins. Critics and hackers alike are continually searching for weaknesses, and occasionally they find them, as evidenced by the Mt. Gox and Youbit hacks.

More recently, it has been revealed that the EOS cryptocurrency network suffered glitches in its operating system that resulted in nearly 20,000 missed data blocks per day over a week’s time.

- Government regulation and interference – Although no government backs cryptocurrency, certain U.S. government agencies have stepped into the cryptocurrency arena to regulate its release (ICO), regulate its trading, and even tax the proceeds earned by U.S. crypto holders. All of these factors have the potential to add to crypto volatility.

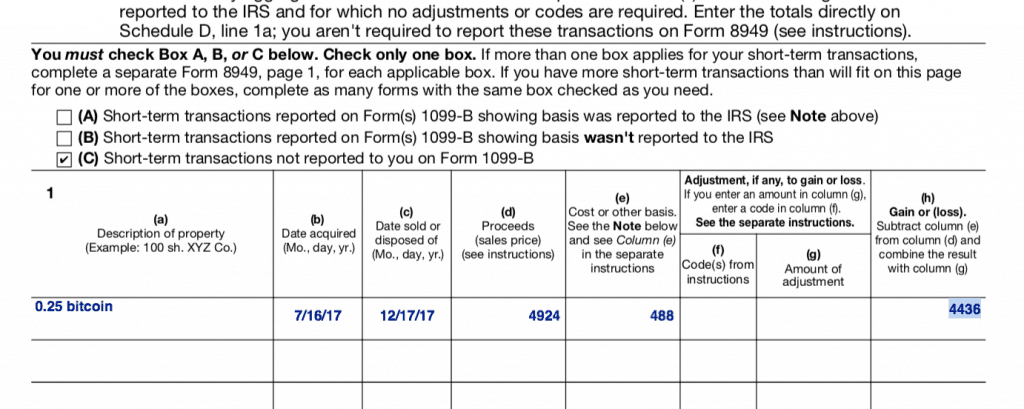

- The Internal Revenue Service (IRS) considers digital currencies such as Bitcoin and other crypto as “property” for federal tax purposes. Therefore, the same general tax regulations that apply to property transactions will also apply to cryptocurrency.

- Depending on the circumstances, the Securities and Exchange Commission (SEC) may consider virtual coins or tokens to be securities within the meaning of federal securities laws, thereby opening the door to federal involvement.

- The Commodity Futures Trading Commission has determined that Bitcoin and other cryptocurrencies are commodities within the meaning of the Commodity Exchange Act and subject to regulatory oversight concerning fraud and manipulation issues.

Some people believe that there is a need for these agencies to step in and protect investors and prevent fraud. But the fact that these heavy-handed offices of the U.S. government have formally announced their intention to monitor cryptocurrency activities seems to go against the basic principles of cryptocurrency.

Particularly in the case of IRS involvement, potential tax liability could hinder the growth of cryptocurrency as a viable medium of exchange and prevent it from reaching a certain level of critical mass necessary for it to become mainstream.

What Does the Future Hold for Cryptocurrency?

Although cryptocurrency has only been around for about a decade, if the staggering market capitalization numbers are any indication, it is not going anywhere. If anything, perhaps paper currency is on its way out the door. The rollercoaster crypto market is a harsh reality at this stage; even when values plummet, what some view as a flash crash others view as a healthy pullback.

One thing is clear: if it has not already, cryptocurrency will soon find its way into your life whether in the way that you pay for things or get paid for things that you do, finance an acquisition, engage in an international transaction, or it may even pop up in an article you read somewhere online.

The Cryptocurrency Forums is an Amazon Associate. As an associate, we earn from qualifying purchases. We are also an affiliate of Trezor, Ledger, Coinbase, NordVPN, Ezoic, and WPX. Use of affiliate links does not add any cost to the buyer.