Opinions are those of the author. Repost with permission. Original blog XRPHodor

Twitter @hodor7777

In these days of the crypto revolution, it’s difficult for some investors to discern between hyperbole by the championing organization, and actual market potential.

Each coin vies for an increasing market share of crypto investment money, and sometimes the organization responsible for constructing and executing adoption business plans may make profound statements that remind us of a used car salesman trying to offload a rusty sedan on an unsuspecting young buyer. But what if you happen to run into the rarity – a situation where you discover a fantastic product that has no salesman at all? What if the business refuses to engage in the ‘usual’ sales tactics for that industry, and just lets its product speak for itself?

Note that Ripple has an established reputation for remaining focused and pragmatic when it comes to blockchain technology. When they encounter obstacles – whether business or otherwise, I’ve seen them analyze the situation carefully before deciding on a plan for overcoming the problem. It’s impressive to watch. In addition, they have consistently been low-key about challenging the industry leaders, despite the market deciding in late December of 2017 that it was time for XRP to make a run up the rankings.

When XRP’s market cap passed Ethereum and started eating up Bitcoin’s share in late December and early January of this year, it reminded everybody that the future of the crypto market is around the corner.1

Now we’re seeing a freight train of progress for the adoption of every solution that  Ripple offers – xCurrent, xRapid, and xVia. So when I saw that the UK Express had published an interview with Danny Aranda (Ripple’s European Managing Director) dramatically titled “Ripple cross-border takeover: Cryptocurrency Giant Plotting Worldwide Transaction Takeover,” I just nodded and said to myself, No kidding! Somebody woke up and realized what was happening. 2

Ripple offers – xCurrent, xRapid, and xVia. So when I saw that the UK Express had published an interview with Danny Aranda (Ripple’s European Managing Director) dramatically titled “Ripple cross-border takeover: Cryptocurrency Giant Plotting Worldwide Transaction Takeover,” I just nodded and said to myself, No kidding! Somebody woke up and realized what was happening. 2

Takeover In Progress

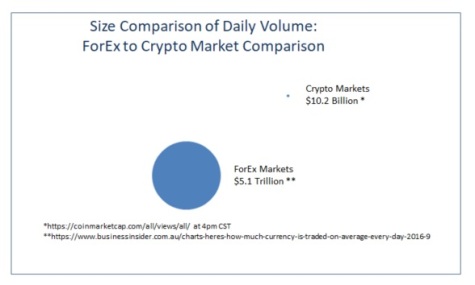

Danny Aranda correctly noted the difference in size between the crypto markets and the current ForEx market. While the press talks a good game in terms of blockchain technology’s potential for moving money worldwide, the reality is that the crypto market is not even close to catching up yet with traditional methods of value transfer. Here is the visual difference between the daily volume of ForEx on traditional markets versus the amount of value that is transferred daily over various crypto networks (including the XRP Ledger): 3 4

In the article, Danny Aranda commented:

“So this is an order of magnitude smaller than our traditional markets that we have around in the present day.”

He also went on to discuss his positive outlook about Western Union, who announced on February 14th that they were trying out XRP as a bridge currency: 5

“We would look at someone like Western Union as a potential customer or a potential partner who can use our infrastructures.”

The potential xRapid deal with Western Union is but one measure of XRP’s growing global reach – remember that MoneyGram is also piloting xRapid. 6

This recent phrasing of a ‘takeover’ by Ripple is spreading to other news outlets as well, with some noting a building trend within the banking and FI space. In a recent article, the Stock Gazzette indicated: 7

“…it appears Ripple have an even grandeur plan in the pipeline. And the likelihood is that it will incorporate Western Union. Summarized, it simply boils down to one thing, and which many other cryptocurrencies are fighting to achieve: worldwide use if not complete takeover.”

It seems that now that it was discovered that not only MoneyGram but Western Union is piloting xRapid, the evidence has reached a level of irrefutability that even the most skeptical analysts are pausing and having to consider the strong possibility that Ripple is about to transition the entire global money transfer infrastructure using its technology – with a combination of its software packages.

[It’s tax season. Are you familiar with the process of filing your capital gains? Read more in our 2017 tax article.]

Ripple News

In the past few days, the news hasn’t stopped for the largest fintech company in the world. If anything, adoption and enthusiasm towards Ripple technology has now started to circle the globe and take over any serious discussion of banking technology’s future.

To willfully ignore Ripple technology would be a dangerously head-in-the-sand move for any bank or financial institution at this point. The one organization that has deliberately avoided conversations about its nascent replacement is SWIFT, the legacy messaging organization that is desperately seeking to forestall its imminent loss of relevance.

Interview with Marjan Delatinne

On March 8th, Veronica Rinecker from Cointelegraph recently interviewed Marjan Delatinne, Ripple’s Global Head of Banking, about various topics, including some questions pertaining to RippleNet membership. 8

In the first introductory response, Marjan referenced her past with SWIFT:

“I was working for SWIFT in the past, and correspondent banking is a core business of SWIFT. There are a lot of pain points and problems – and I want to change it.”

Although this response was one of those safe responses that you sort of expect when you ask a person about their transition from one employer to another, it also indicated something a bit more subtle – and that is, sometimes you need an entirely new organization to affect change. I’ve discussed SWIFT in the past, and also the enduring characteristics of an organization’s culture and track record, but it’s fascinating to have some of my comments be confirmed with tangible actions by prominent executives that have left SWIFT in the past like Marjan Delatinne.

Another question that was asked of Marjan was regarding how Ripple attracts new partners, and what are the key communication challenges. Her response:

“It takes time to attract new partners, especially big organizations. They have more complex legacy systems and if they invest, they have to be sure that their investment is bringing a return. But we see a significant change in terms of the way the banks are talking to Ripple. The trust that now has been built around Ripple and the fact that a lot of big players are already in our network – for example, Bank of America – make our new partners more confident that Ripple is working.”

Not everybody realizes that Bank of America is a Ripple partner, and her mention of this partnership with the second-largest US Bank in the world was a subtle reminder.

[See more XRP coverage from XRPHodor in this post]

Cory Johnson

If you haven’t read the biography of Ripple’s newest team member, Cory Johnson, you are missing out.

He has a long entrepreneurial history in journalism, helping to start and grow magazines such as SLAM and TheStreet, two very different but highly popular news sites. In addition to his entrepreneurial and managerial resume, he is an experienced communicator on-camera, co-hosting programs on Bloomberg with Emily Chang. 9 He’s covered serious journalistic topics such as organized crime, and he is also a respected member of the organization of Investigative Reporters and Editors. 10

In addition to his media resume, he also is a noted financial analyst, having worked for Kingsford Capital Management and Cannell Capital LLC.

On March 9th, it was announced that he had made the decision to leave his current endeavors and become part of team Ripple. 11 Ripple conducted an interview and published it on its Insights post-board.

One of the questions they asked was regarding how Cory’s experience as both a reporter and a hedge fund manager translates to what he’ll do at Ripple. Here was his answer:

“I believe in Ripple and I’m convinced that the technology is real and revolutionary. But I am also convinced that a lot of blockchain-related companies and crypto projects are exaggerated. This space is confusing and over-hyped.”

Spot on, right? I think we’ve all reached a similar conclusion on our own after comparing XRP to other cryptographic networks that currently comprise the top three in the crypto market.

[Join in the latest crypto discussions on XRP and many other topics. Set up your free account here. No spam or newsletters will be sent.]

(Asia) Money 20/20 Conference in Singapore

Ripple is scheduled to attend the first Asia-specific Money 20/20 Conference in Singapore taking place March 13-15 this week.12 Yes, Brad Garlinghouse is slated as one of the speakers at the conference.

However, here’s something you may not know: Takashi Okita, head of Ripple & SBI’s Ripple-Asia team, is also slated as one of the speakers. It doesn’t end there. Ripple is also fielding a third speaker at this event: Sagar Sarbhai, Ripple’s Head of Regulatory Relations for Asia-Pacific & the Middle East.

What is Money 20/20? Here is how the organizers explain it: 13

“Money20/20 is where the Payments, FinTech and Financial Services ecosystem unites to create and explore the disruptive ways in which consumers and businesses manage, spend and borrow money. It’s the premier event where leaders – representing every sector of the industry – come to seize new business opportunities, build connections and learn about the latest disruptions.”

In case you’re curious, there is also a (USA) Money 20/20 Conference in the works as well, scheduled for October 21-24 at the Sands in Las Vegas. 14

Omni

Not too long ago, you might have seen some headlines that announced a high-profile investment by Ripple in Omni, an Internet sharing-application based business in California. It was a substantial investment by Ripple, and it drew attention to the fact that cross-border payments, and perhaps micropayments, might be a good fit for some of these new Internet ‘sharing’ companies.

The latest news with Omni is that it recently hired a new Director of Business Operations – Ellia Chon. Thomas Mcleod, the founder of Omni, had this to say: 15

“Ellia Chon, a finance and strategy expert formerly at Airbnb and Salesforce, has joined our team as Director of Business Operations.

Ellia’s leadership role at Omni will focus on two key areas: business strategy and financial rigor. She will be a crucial decision maker for Omni, developing frameworks around unit economics, market expansion, and pricing to drive growth and profitability.”

I see this as a natural fit for Omni, given Ellia’s background with AirBnB, another Internet sharing company.

[Not interested in XRP? Maybe Anonymous Coins are more your style]

Exchange News – Zebpay Finished Integrating XRP

The most recent exchange to add XRP to its list of traded currencies is Zebpay. While I first reported on Zebpay’s decision to add XRP support in a blog on February 12th, it’s great news that it’s only taken a few weeks for the company to follow-through on its promise to give investors what they were asking for. 16

The size of Zebpay is impressive: the company’s official website boasts that it has three million users of its mobile trading application. Also keep in mind that even though it doesn’t have a brick-and-mortar presence, it is considered an Indian exchange, and it supports direct XRP:INR pairings. 17

Ripple Collateral: Seven New Videos Explaining Ripple and XRP

In one fell swoop, Ripple released seven videos that they’d produced as part of a comprehensive video series on the history of Ripple, the XRP Ledger, and its vision and marketing strategy. The move was a surprise, and to the delight of the XRP investment community, contained interviews with the titans of the organization, including Chris Larsen, Brad Garlinghouse, Asheesh Birla, Stefan Thomas and the XRP community’s fan favorite David Schwartz.

One of my favorite stories to emerge from the video series was Chris Larsen discussing how they had to acquire the rights to the Ripple website from a Grateful Dead fan in 2012:

“It came from a Grateful Dead super-fan; it’s related to the song “Ripple.”

It was one of the lighter moments in the educational series. The videos serve to provide a compelling background for new researchers curious as to the origins of the company and the technology that underpins the digital asset XRP.

For those that would like to watch for themselves, here is a rough table of contents for the seven videos:

“Ripple and XRP – Part 1: How Ripple Got Started”

“Ripple and XRP – Part 2: The Internet of Value”

“Ripple and XRP – Part 3: Ripple’s Vision for XRP”

“Ripple and XRP – Part 4: Ripple’s Product Suite”

“Ripple and XRP – Part 5: XRP vs. Other Digital Assets”

“Ripple and XRP – Part 6: Is XRP Decentralized?”

“Ripple and XRP – Part 7: Consensus vs. Proof-of-Work”

How Soon Before The Takeover Is Complete?

For people like me, I see the obvious benefits of XRP when comparing it with virtually any of the other choices in crypto. I’ve compared XRP to other digital assets in a methodical fashion in prior blogs, to bring new researchers up to speed on the basics. It’s interesting to watch the eye-opening reactions to people that are new to crypto. They squint, shake their heads, and then ask “what’s the catch?”

There is no catch.

It’s really that good: This is why it quickly consumed a huge percentage of the entire crypto market in its December rally, and it’s also why banks and other financial institutions are adopting its usage as we speak. It’s no longer hyperbole to talk about Ripple technology taking over the entire global banking and payments infrastructure; it’s just common sense for those of us that understand what the XRP Ledger means for global commerce. ![]()

[Register for a free account and join us in our Ripple forum}

Sources:

- https://coinmarketcap.com/historical/20180107/

- https://www.express.co.uk/finance/city/929604/Ripple-price-news-XRP-coin-buy-cryptocurrency-USD-bitcoin-Danny-Aranda

- https://www.businessinsider.com.au/charts-heres-how-much-currency-is-traded-on-average-every-day-2016-9

- https://coinmarketcap.com/all/views/all/

- https://fortune.com/2018/02/14/ripple-xrp-western-union-money-transfers/

- https://fortune.com/2018/01/11/ripple-moneygram-xrp-cryptocurrency-bank-transfers/

- https://stocksgazette.com/2018/03/10/ripple-xrp-and-its-master-plan-beyond-2018/

- https://cointelegraph.com/news/ripples-new-global-head-of-banking-talks-about-ripplenet-psd2-and-the-future-of-payment

- https://en.wikipedia.org/wiki/Cory_Johnson

- https://www.cnbc.com/2018/03/08/ripple-hires-bloomberg-tvs-cory-johnson-as-chief-market-strategist.html

- https://ripple.com/insights/ripple-welcomes-cory-johnson-chief-market-strategist/

- https://asia.money2020.com/speakers

- https://us.money2020.com/overview

- https://us.money2020.com/?utm_source=google&utm_medium=cpc&utm_term=money%2020%2020%20conference&utm_campaign=Brand

- https://blog.beomni.com/announcing-ellia-chon-as-director-of-business-operations-8ca9960a157b

- https://blog.zebpay.com/introducing-ripple-on-zebpay-8519ecdd25bf

- https://coinmarketcap.com/exchanges/volume/24-hour/

Powered by WPeMatico