Rockefellers to Invest in Blockchain Startups

The venture capital arm of the Rockefeller family is moving into the cryptocurrencies arena. With an aim helping entrepreneurs launch blockchain-based businesses, Venrock is partnering with CoinFund, the cryptocurrency investor group. David Pakman, Venrock partner told Fortune that “We wanted to partner with this team that has been making investments and actually helping to architect a number of different crypto economies and crypto token-based projects.”

Discuss this news in our forum thread.

According to reports, Venrock has about $2.6 billion worth of assets under its management. According to Packman, Venrock is less focused on short-term profits and is focusing on making a long-term investment in the virtual currency and blockchain technology industry. Pakman said, “There are a lot of crypto traders in the market.” He also added, “There are a lot of cryptocurrency hedge funds. This is different. To us, it looks a little bit more like venture capital.”

Jake Brukhman, co-founder of Coinfund told Fortune that his firm is looking forward towards the influx of Establishment Money into the upcoming crypto market and this will help boost the cryptocurrency scene in New York. He said, “We’ll be working closely with [VenRock] to help mentor, advise, and support teams in the space.” He also added, “We’re trying to cultivate a unique synergy between teams as we see more experienced founders and more traditional tech startups taking up blockchain.”

The entry Rockefellers into the cryptocurrency arena does signal that the blockchain technology which undergirds bitcoin has been too hyped to be ignored and too big to be merely dismissed. (Is the 2018 bear market coming to an end?)

{Don’t have your own venture capital firm? Be sure to read our latest crypto investing tips article.}

Brain drain from Wall Street towards Crypto Merchant Bank

According to reports in Bloomberg, Galaxy Digital, a cryptocurrency merchant bank which was founded and is being run by former Wall Street executive Mike Novogratz is reported to be hiring Richard Kim (an executive of Goldman Sachs) as the new chief operating officer. According to Forbes, Novogratz is one of the crypto’s richest people in the world, having previously served 11 years at Goldman Sachs left Wall Street in 2015 after two years of losses at the Fortress Investment Group. He also termed cryptocurrencies as the “biggest bubble of our lifetime,” and also stated, “you can make a whole lot of money on the way up, and we plan on it.”

An unnamed source said that Kim had been working on setting up a crypto trading desk at the Goldman, but left recently, according to Bloomberg. Back in January of this year, Goldman Sachs’ CEO had refuted reports that they were opening a crypto trading desk even though the firm since 2015 has owned a stake in a crypto trading desk. According to his LinkedIn profile, Luka Jankovic, a former Goldman Sachs employee is also employed at the Digital Galaxy as a senior investment associate. Lately. the cryptocurrency sector and Wall Street has been inching closer together.

{Google’s ban on crypto ads is set to be in effect June 2018. The effects remain to be seen.}

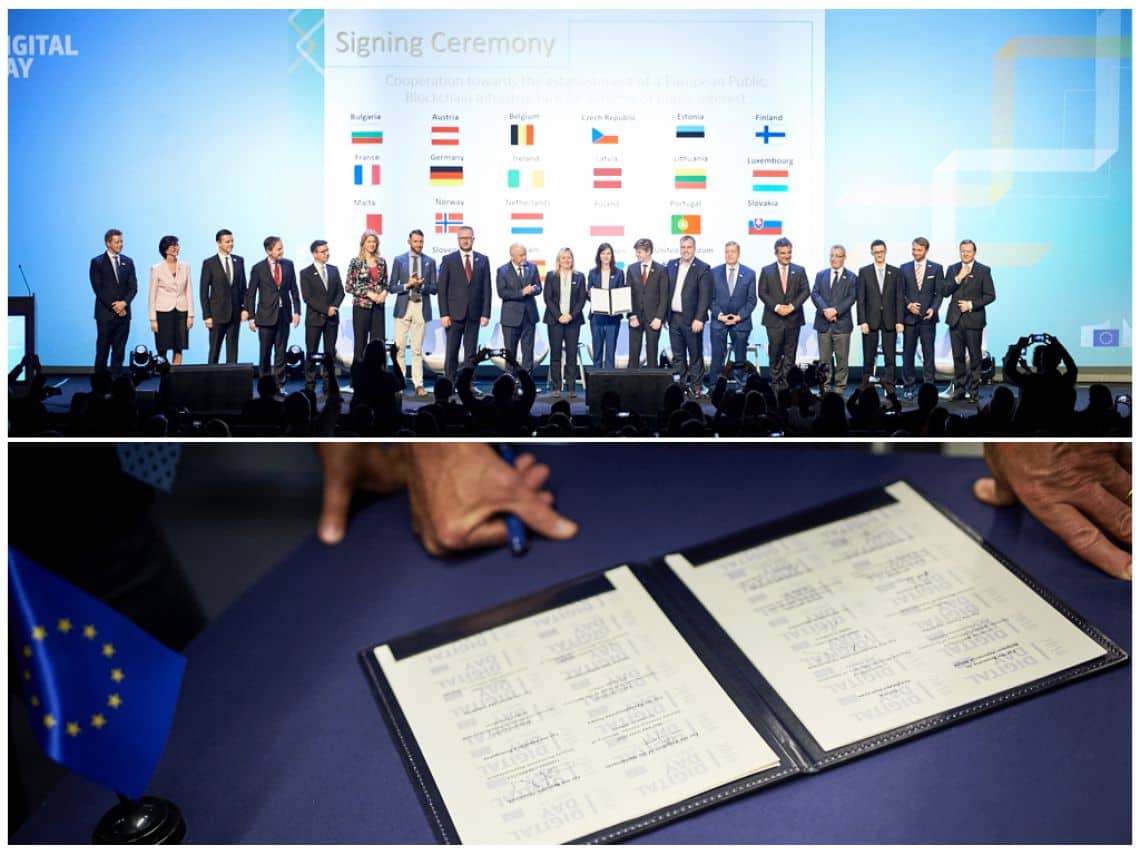

European Nations Unite Together With Blockchain Partnership

22 European countries during last week came together to cooperate on Blockchain regulation and education. According to the press release of European Commission, the European Blockchain Partnership “will be a vehicle for cooperation amongst the Member States to exchange experience and expertise in technical and regulatory fields and prepare for the launch of EU-wide blockchain applications across the Digital Single Market for the benefit of the public and private sectors,”

The complete list of the nations participating in the same are “Austria, Belgium, Bulgaria, the Czech Republic, Estonia, Finland, France, Germany, Ireland, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and the U.K. An invitation to join the partnership has been extended to “other countries, Members of the EU and of the European Economic Area.”

{The crypto markets can swing quickly, as you can see by comparing our Feb news to today’s update.}

The partnership which is led by the European Commission aims to make sure that in the coming years Europe stays at the forefront of blockchain development. The press release means that the commission has given a nod to the blockchain technology with the aim to promote user trust. In addition, it is firmly believed by the partnership that this will act as a fundamental role in various digital services in future, which includes, finance, logistics, and regulatory reporting.

The participating nations foresee the possibility for blockchain technology to integrate with Digital Single Market of Europe which aims to unite the disparate online markets of Europe into one. The partnership, like the Digital Single Market, will try to avoid disjointed approaches among EU and European Economic Area members to blockchain development. The partnership aims the cooperation will result in smooth interoperability amongst nations with blockchain technology “in full compliance with EU laws and with clear governance models that will help services using blockchain [technology] flourish across Europe.”

Mariya Gabriel, the European Commissioner for Digital Economy and Society stated that “In the future, all public services will use blockchain technology. The blockchain is a great opportunity for Europe and the Member States to rethink their information systems, to promote user trust and the protection of personal data, to help create new business opportunities and to establish new areas of leadership, benefiting citizens, public services and companies. The Partnership launched today enables Member States to work together with the European Commission to turn the enormous potential of blockchain technology into better services for citizens.”

Questions or comments about this story? Check out the discussion thread in our forums.

Chinese Fund Supports Blockchain Startups

During last week, Xiong’An established Global Blockchain Innovation Fund worth 10 billion yuan or $1.6 billion towards the promising blockchain startups in China. It was during the grand opening of the Hangzhou Blockchain Industrial Park in China that the announcement was made. The fund is a joint effort of the Hangzhou Yanqi Investment Management Co. and the Future Science and Technology City Administrative Committee of Yuhang District Government. according to a report in Sohu, “Government-guided funds” accounted for 30 percent of the investment.

One of the most celebrated angel investors in China, Xu Xiaoping will act as the fund advisor. The announcement of the fund and the opening of the industrial park reinforces the fact that Hangzhou is the rising center of blockchain technology in China. A great importance of blockchain technology has been provided by the government in Hangzhou and ranks it behind virtual reality technologies and artificial intelligence.

{Register for a free account and head to the discussion thread for more on this news}

There are various firms in China who have been making a bid to support blockchain technology. Alibaba rival JD.com, in February 2018 announced its plans to launch a new accelerator program for blockchain and artificial intelligence startups based in Beijing. the state-owned Bank of China, in September 2017 filed a patent application for a process which scales blockchain systems.

However, all of these firms will have to deal with the regulatory uncertainty in the country, regardless of the spate of enthusiasm to delve into the blockchain space. China has been increasingly clamping down on initial coin offerings (ICOs), cryptocurrencies, and cryptocurrency exchange trading with an aim to stem capital outflow and corruption.

Santander to Launch Ripple Payment App

Santander Group, a Global banking giant is said to launch an application based on blockchain for cross-border foreign exchange. The app named One Pay FX is to be released in four countries namely, Spain, the U.K., Brazil, and Poland for the customers of Santander, according to reports by the Financial Times.

The group said in the coming months it expects to introduce the service for small businesses in additional countries and might provide the same to other financial institutions. The app marks Santander as one of the first banks to offer blockchain-based foreign exchange payments for consumers. The app is built on distributed ledger technology provided by Ripple is launching after two years of development. According to the report, the app which covers forex transactions from the four nations could account for about half of the retail customers of Santander.