Arizona Signs Blockchain Bill into Law

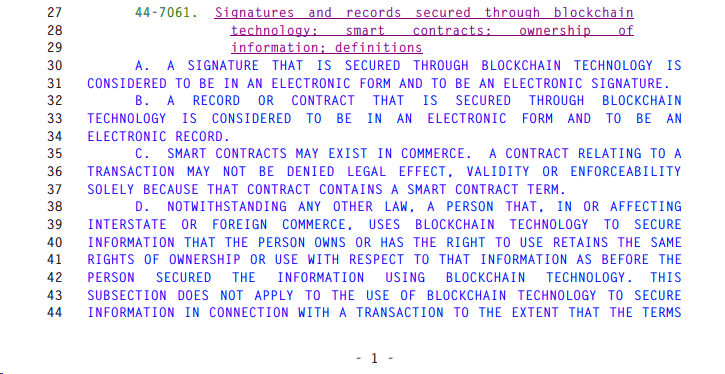

Amongst the Blockchain-friendly states, Arizona advanced its ranking by bringing in the corporations one step closer to submitting all of their data on the distributed ledger technology. As an amendment to the Arizona Revised Statutes, Doug Ducey, the governor signed the Corporations/Blockchain Technology bill or House Bill 2603 which already supports “signatures and records secured through blockchain technology and smart contracts.” However, with the amendment, the data which is shared and stored by corporations on the blockchain also becomes valid.

The first time the blockchain bill of Arizona was introduced to the House in February and it was in a matter of weeks that it passed the State Legislature. A strong support was received by HB 2603 from the lawmakers with only a handful of ‘nay’ votes in the House and unanimous support from the Senate. In late March, the bill was transmitted to the desk of Governor Ducey and was signed into law on April 3.

Representative Jeff Weninger who is a champion for blockchain innovation in the state and the sponsor of the bill told a local news publication that “The goal is to allow in a couple years for corporations to submit their records on a blockchain.” Rep. Weninger, last year at about this time introduced the law that recognized smart contracts and blockchain-fueled signatures as valid which brought forward the innovation which would follow from policymakers looking to catapult their state as a source for innovation.

Another bill by Weninger is ‘Running Nodes/Blockchain/Regulation Prohibition act’ which focuses on blocking cities from preventing an individual “from running a node on blockchain technology in a residence,” or cryptocurrency mining. He is of the view that the decision must be made at the state level. In the meantime, the pendulum is swinging to the other side in Washington wherein the policymakers for the time being have placed a moratorium on bitcoin mining applications.

South Africa sets Self-Regulation Organization for Cryptocurrency

In the entire African continent, South Africa is positioning itself as the frontier of cryptocurrency regulation. By coming up with a special investigative unit, the South African Reserve Bank (SARB) is making steps in the digital space which will control the developments in the cryptocurrency industry in the nation. The development of proof of concept (PoC) for DLT-based money transfer system among the banks will be amongst the additional duties of the self-regulatory organization (SRO).

Register here for a free account to discuss news and investing.

Bridget King, Director of Banking practice at SARB stated that “Regulating cryptocurrencies prematurely could have the negative consequence of throttling the growth and innovation of the industry.” Bridget, while commenting on the usefulness of the PoC in the DLT- based system said that “The aim of this project is to gain a practical understanding of DLTs through the development of a PoC in collaboration with the banking industry. The objective of the POC is to replicate interbank clearing and settlement on a DLT which will allow the Sarb and industry to jointly assess the potential benefits and risks of DLTs”

George Soros Fund to Trade Cryptocurrencies

According to reports by Bloomberg, George Soros, who runs the $26 billion investment firm has been a cryptocurrency bear for a long time has been reported to start trading the digital currency at his New York-based family office. Back in January, Soros called the high-flying cryptocurrency market a bubble. As per the report Adam Fisher who is responsible for overseeing macro investing at the Soros Fund Management has received internal approval to make the move in recent months but has not yet ventured into a virtual currency transaction.

Soros on January 25 stated that “As long as you have a dictatorship on the rise you will have a different ending because the rulers in those countries will turn to bitcoin to build a nest egg abroad.” The digital currency since his remarks has lost about a third of its value as investors fear some broad-based regulations by governments across the globe which includes crackdown in South Korea. Soros’ family office according to the regulatory filings for the fourth quarter of 2017 showed that they were the third-largest shareholder of Overstock.com which is a home goods e-commerce company and has drawn the interest of the Wall Street owing to its plans to develop a digital asset trading platform.

US Tax Liabilities for Cryptocurrencies seen at $25 billion in 2017

According to a research note by Fundstrat Global Advisers, the soaring prices of cryptocurrencies last year are estimated to have resulted in tax liabilities of about $25 billion in the US. The firm said that it could result in a massive outflow from the cryptocurrencies to the dollar by April 17, which is the deadline for filing taxes this year. Thomas Lee, Fundstrat’s co-founder and head of research and former chief equity strategist from at J.P. Morgan 2007 to 2014 said: “We believe selling pressures (in crypto) have been amplified by capital gains tax-related selling this year,”.

{US tax return deadline is fast approaching. Need help? Start here.}

Fundstrat still believes that after April 15 tax deadline the outlook for bitcoin should improve. The firm restated its year-end forecast of $25,000 and mid-year target of $20,000. The tax liability of $25 billion accounts for a fifth of the expected total tax payment for capital gains in the year 2017. It also stated that record profit in November and December were recorded by crypto exchanges and are expected to have huge tax liabilities which will add onto additional selling in cryptocurrencies. The research firm added that majority of the exchanges have a net income exceeding $1 billion in the year 2017and has its working capital in ether and bitcoin. Exchanges need to sell bitcoin and ether to meet these tax liabilities.

Taiwan Proposes Money Laundering Rules for Digital Assets

The Governor of Central Bank of Taiwan, Yang Chin-long assured the legislative arm of the government last week that central bank is working on developing anti-money laundering rules for Bitcoin. He also stated that the movements in the Bitcoin market have been monitored and are still being monitored. Moreover, Yang in response to the concerns on “opacity” in the digital market said that the bank will take the responsibility of warning the public on the risks tied to Bitcoin investments.

It has been proposed by the Central Bank that the nation must adopt for the Bitcoin trading the current anti-money laundering (AML) measures must be adopted. This proposal has been forwarded to the Ministry of Justice already. In light of latest developments surrounding cryptocurrencies, it is a big step for the Taiwanese government even though the proposal remains in the initial phase. The finance minister, last month proposed that cryptocurrencies should be taxed as virtual commodities. Since most Asian countries have already put up crypto regulations, Taiwan is trying to catch-up with them.

{The crypto markets can swing quickly, as you can see by comparing our Feb news to today’s update.}

India Central Bank to Stop Dealing With All Crypto-Related Accounts

In India, the Special Investigation Team (SIT) on black money has requested the probe agencies to curb and check the usage of cryptocurrencies in its process of reviewing the circulation and operation in the country and possible links to shady offshore transactions. According to the officials, a meeting was held by the SIT in the national capital wherein it was informed regarding the general situation of the operations of the virtual currency in the country. Official sources said that the SIT called cryptocurrencies like bitcoin “illegal” and asked probe agencies like Narcotics Control Bureau (NCB), Income Tax Department, and the Enforcement Directorate (ED) to identify and stop its use and check the transactions which are done over the internet which includes cross-border ramifications.

A report will be prepared by the panel which would be submitted to the government in some time. A senior official said that “The government is the final authority to frame rules and law to regulate these virtual currencies and the SIT would provide its report to it on the subject.” The NCB informed the SIT during the meeting that in the last over two years’ time about four cryptocurrency-fueled drugs smuggling transactions have been unearthed in the country. In addition, the department of Income Tax reported about the searches it conducted on bitcoin exchanges across the country last year.

The Cryptocurrency Forums is growing in 2018. Register for a free account using this link and join the discussions. No email marketing, spam or newsletters.

Join our discussion on this market downturn in our latest forum thread on crypto markets.