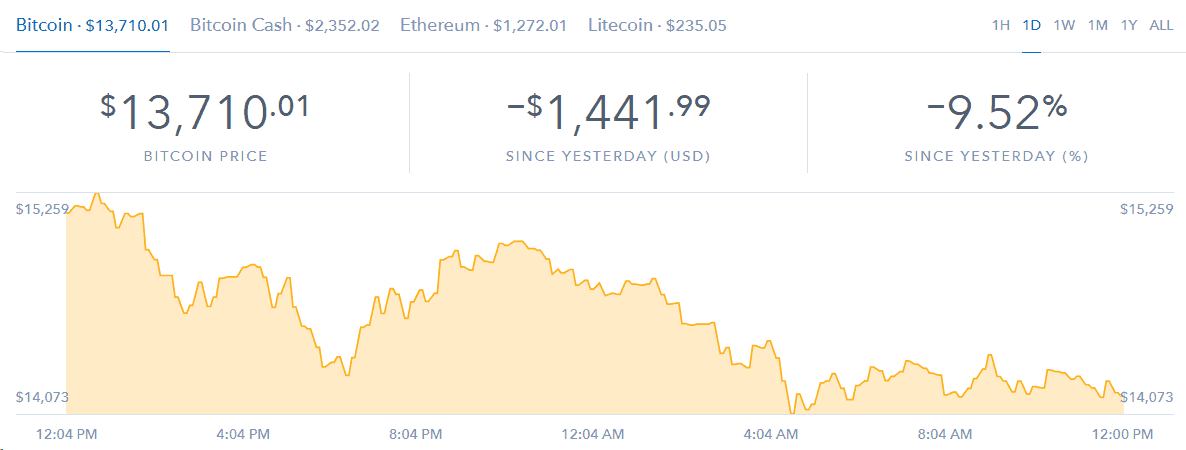

The largest market cap cryptocurrency Bitcoin continues to extend the selling pressure for the fourth consecutive session this week, currently trading at $13,710.01, down -9.52% for the day.

After Microsoft Corporation removed the option of Bitcoin payment from its active payment instruments, the market doubt increased over its sustainability, and the general sentiment revolving around Bitcoin remains majorly undermined. The risk for more firms like Microsoft declining bitcoin seems to have increased, especially with the increased volatility and unstable price movement during the last quarter.

Yesterday’s news that Coinmarketcap removed the prices from South Korean exchanges without any prior warning added to the negative sentiment prevailing around Bitcoin and crypto markets.

Moreover, the selling pressure was further accelerated by the latest reports that China may be further restricting cryptocurrency mining; the Chinese central bank is consideration some additional actions. The recent regulatory crackdown in South Korea resulted in latest declines in the majority of the high trade volume cryptocurrencies like Litecoin, Ripple, IOTA etc. South Korean regulators on Monday inspected six major local banks wherein they reviewed the anti-laundering measures of the institutions in connection with cryptocurrency trading.

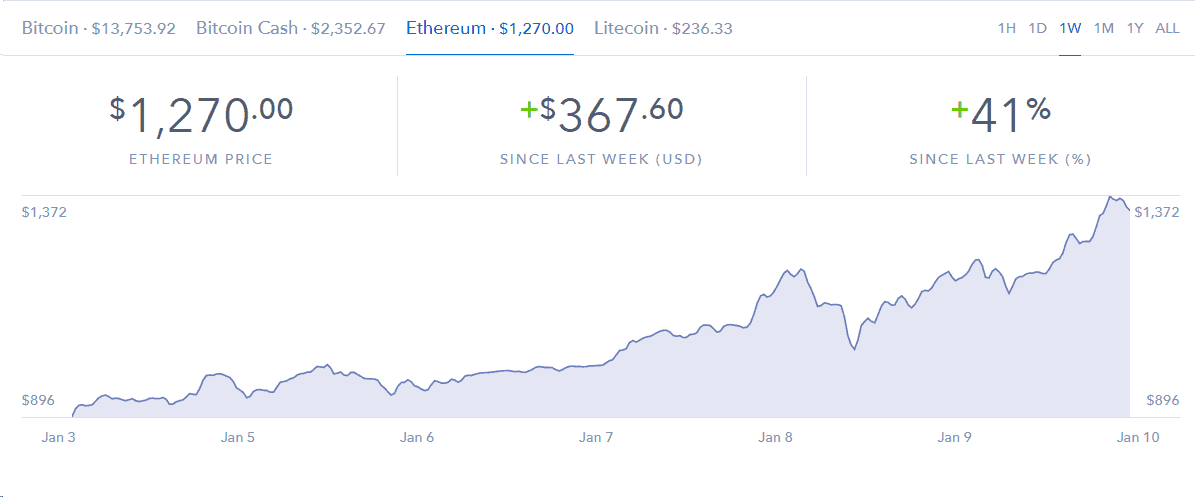

Ethereum on the other hand continues to rally, supported by the recent comments from Steven Neraoff, the co-creator of Ethereum, and trades at $1,270.00, up 41% for the week. On Monday, Nerayoff said on CNBC that

“What you’re seeing with Ethereum is exponential increase in the number of projects — there are billions of dollars being poured into the ecosystem right now — maybe 10 times more projects this year than last year, which could easily lead to a doubling, probably a tripling in price by the end of the year.”

However, Tom Lee who is the Head of Research and Co-founder at Fundstrat Global Advisors noted saying in an interview at CNB that Bitcoin could shrug-off the recent sell-off and could easily double during 2018. He said

“Even on a risk-adjusted basis, I think bitcoin is going to easily outperform the S&P. On a long-term basis, [the easiest way to look at bitcoin is] as a replacement or a store of value. So as millennials discover and generate income, they’re going to use it as a replacement for gold “

He further said that, on a near-term basis bitcoin is expected to reclaim its highs achieved in December last year

“We think that by mid-2018, we’re going to be part of the way there, and that’s why we get [bitcoin to $20,000],” he said. “If [bitcoin] can actually rise close to [that $20,000 level] in the first half of this year, I think in the second half of 2018, we’ll see a move bigger than that. So I think bitcoin is still something you should own [all year].”