CoinSwitch_co

Contributor

The Verge, Bitcoin Gold And MonaCoin Hacks: All You Need To Know

imagehack.eu

Verge (XVG), Bitcoin Gold (BTG) and MonaCoin (MONA) suffered the 51% attack during the same timespan. Coins worth millions of dollars were stolen as a result of these Proof Of Work (POW) coin hacks.

Verge (XVG) Hack, 2nd time last 2 months

Verge has suffered the attack, 2nd time in last 2 months. The attacker has generated around 35 million XVG coins worth 1.7 million USD.

The theft occurred when hackers exploited a specific glitch in Verge’s technology by mining multiple blocks virtually one second apartusing the same algorithm. This was the same tactic used in a hack just last month that saw over 250,000 XVGs stolen, forcing Verge to prepare a subsequent hard fork.

The same was accepted ay the Verge team on twitter on 22nd May:

Reddit user ocminer was the first to notice both attacks. The user commented that Verge’s system had not been properly repaired since April, and that “since nothing really was done about the previous attacks (only a band-aid), the attackers now simply use two [algorithms] to fork the chain for their own use and are gaining millions.”

The Verge Price graph

The attack happened just a few days after the China ranked Verge at #13 with Bitcoin in the list of top cryptocurrencies.

Bitcoin Gold (BTG) Attack

The 26th-largest cryptocurrency Bitcoin Gold was attacked by the malicious miners and he was able to double spend the millions worth of coins.

To execute the attack, the miner acquired at least 51 percent of the network’s total hashpower, which provided them with temporary control of the blockchain. Obtaining this much hashpower is incredibly expensive — even on a smaller network like bitcoin gold — but it can be monetized by using it in tandem with a double spend attack.

After gaining control of the network, the attacker began depositing BTG at cryptocurrency exchanges while also attempting to send those same coins to a wallet under their control. Ordinarily, the blockchain would resolve this by including only the first transaction in the block, but the attacker was able to reverse transactions since they had majority control of the network.

Consequently, they were able to deposit funds on exchanges and quickly withdraw them again, after which they reversed the initial transaction so that they could send the coins they had originally deposited to another wallet.

Bitcoin Gold’s developers advised exchanges to raise the block confirmation requirements to 50 blocks t avoid such attacks.

A bitcoin gold address implicated in the attack has received more than 388,200 BTG since May 16 (mostly from transactions it sent to itself). Assuming all of those transactions were associated with the double spend exploit, the attacker could have stolen as much as $18.6 million worth of funds from exchanges.

BTG price graph

MonaCoin (MONA) Attack

The Japanese cryptocurrency MonaCoin suffered from a network attack that caused roughly around $90,000 in damages during last week.

The attack appears to have been a selfish mining attack, where one miner successfully mines a block on the blockchain but does not broadcast the new block to other miners. If the secret miner can then find a second block before the rest of the miners find any new blocks, then the secret miner has now effectively created a branch in the chain that is longer than the chain everyone else is working on.

As is standard in most blockchain protocols, the chain with more blocks is considered by the mining network to be the correct chain, as it has the most “proof of work.” So, when the secret miner makes their longer chain public, it invalidates any and all of the blocks discovered by other miners during the time the secret chain was hidden.

Most exchanges have halted all deposits while they work on fixes to prevent possible future similar attacks. Monacoin balances held in wallets are considered safe.

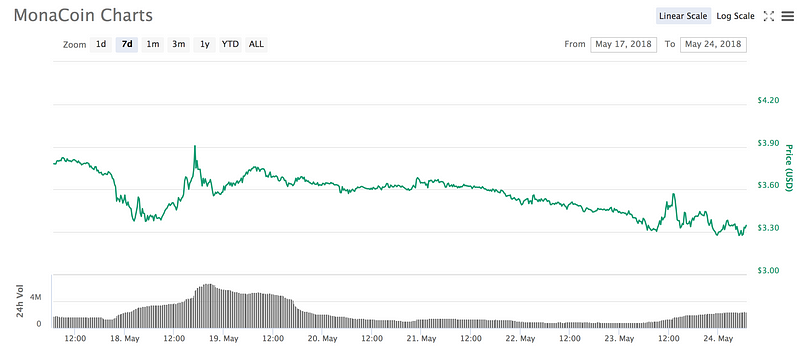

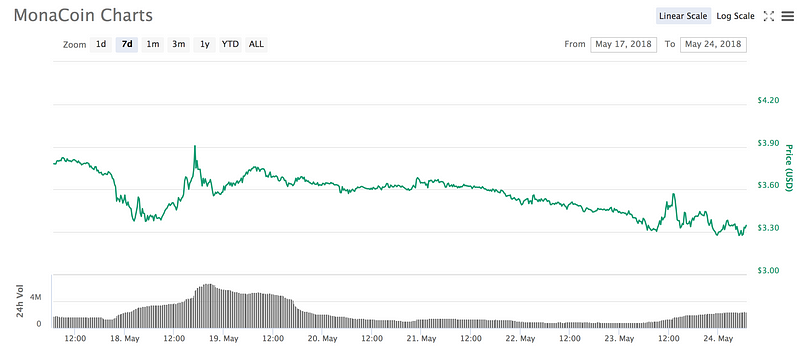

MonaCoin price graph

So XVG, BTG and MONA all three are proof of work coins and the 51% attacks has taken place on all 3 coins differently. Do you think its high time to move on from POW to another more efficient algorithm?

About CoinSwitch:

CoinSwitch.co is the world’s largest cryptocurrency exchange aggregator. It provides exchange service of 300+ coins and over 45,000+ pairs from leading exchanges like KuCoin, Bittrex, Cryptopia, ShapeShift, Changelly, and Changer. It provides an easy way for users to trade coins across multiple exchanges based on price and reliability.

Please do write us to support@coinswitch.co if you have any queries.

Join our telegram group to stay updated on new coin additions and other updates

Happy Switching

imagehack.eu

Verge (XVG), Bitcoin Gold (BTG) and MonaCoin (MONA) suffered the 51% attack during the same timespan. Coins worth millions of dollars were stolen as a result of these Proof Of Work (POW) coin hacks.

Verge (XVG) Hack, 2nd time last 2 months

Verge has suffered the attack, 2nd time in last 2 months. The attacker has generated around 35 million XVG coins worth 1.7 million USD.

The theft occurred when hackers exploited a specific glitch in Verge’s technology by mining multiple blocks virtually one second apartusing the same algorithm. This was the same tactic used in a hack just last month that saw over 250,000 XVGs stolen, forcing Verge to prepare a subsequent hard fork.

The same was accepted ay the Verge team on twitter on 22nd May:

Reddit user ocminer was the first to notice both attacks. The user commented that Verge’s system had not been properly repaired since April, and that “since nothing really was done about the previous attacks (only a band-aid), the attackers now simply use two [algorithms] to fork the chain for their own use and are gaining millions.”

The Verge Price graph

The attack happened just a few days after the China ranked Verge at #13 with Bitcoin in the list of top cryptocurrencies.

Bitcoin Gold (BTG) Attack

The 26th-largest cryptocurrency Bitcoin Gold was attacked by the malicious miners and he was able to double spend the millions worth of coins.

To execute the attack, the miner acquired at least 51 percent of the network’s total hashpower, which provided them with temporary control of the blockchain. Obtaining this much hashpower is incredibly expensive — even on a smaller network like bitcoin gold — but it can be monetized by using it in tandem with a double spend attack.

After gaining control of the network, the attacker began depositing BTG at cryptocurrency exchanges while also attempting to send those same coins to a wallet under their control. Ordinarily, the blockchain would resolve this by including only the first transaction in the block, but the attacker was able to reverse transactions since they had majority control of the network.

Consequently, they were able to deposit funds on exchanges and quickly withdraw them again, after which they reversed the initial transaction so that they could send the coins they had originally deposited to another wallet.

Bitcoin Gold’s developers advised exchanges to raise the block confirmation requirements to 50 blocks t avoid such attacks.

A bitcoin gold address implicated in the attack has received more than 388,200 BTG since May 16 (mostly from transactions it sent to itself). Assuming all of those transactions were associated with the double spend exploit, the attacker could have stolen as much as $18.6 million worth of funds from exchanges.

BTG price graph

MonaCoin (MONA) Attack

The Japanese cryptocurrency MonaCoin suffered from a network attack that caused roughly around $90,000 in damages during last week.

The attack appears to have been a selfish mining attack, where one miner successfully mines a block on the blockchain but does not broadcast the new block to other miners. If the secret miner can then find a second block before the rest of the miners find any new blocks, then the secret miner has now effectively created a branch in the chain that is longer than the chain everyone else is working on.

As is standard in most blockchain protocols, the chain with more blocks is considered by the mining network to be the correct chain, as it has the most “proof of work.” So, when the secret miner makes their longer chain public, it invalidates any and all of the blocks discovered by other miners during the time the secret chain was hidden.

Most exchanges have halted all deposits while they work on fixes to prevent possible future similar attacks. Monacoin balances held in wallets are considered safe.

MonaCoin price graph

So XVG, BTG and MONA all three are proof of work coins and the 51% attacks has taken place on all 3 coins differently. Do you think its high time to move on from POW to another more efficient algorithm?

About CoinSwitch:

CoinSwitch.co is the world’s largest cryptocurrency exchange aggregator. It provides exchange service of 300+ coins and over 45,000+ pairs from leading exchanges like KuCoin, Bittrex, Cryptopia, ShapeShift, Changelly, and Changer. It provides an easy way for users to trade coins across multiple exchanges based on price and reliability.

Please do write us to support@coinswitch.co if you have any queries.

Join our telegram group to stay updated on new coin additions and other updates

Happy Switching