Dutch Court Deems Bitcoin as a Transferable Value

During a case which requested Koinz Trading BV to pay mining proceeds worth $5,000 or 0.591 BTC, a Dutch court, during last week described Bitcoin as a transferable value. The court stated explicitly that given that as a cryptocurrency, it is able to transfer value in a peer-to-peer manner and thus property rights apply to Bitcoin. In addition, it also stated that cryptocurrency is a legitimate transferable value.

The translated version of the court’s decision state that “Bitcoin exists, according to the court, from a unique, digitally encrypted series of numbers and letters stored on the hard drive of the right-holder’s computer. Bitcoin is ‘delivered’ by sending bitcoins from one wallet to another wallet. Bitcoins are stand-alone value files, which are delivered directly to the payee by the payer in the event of a payment. It follows that a Bitcoin represents a value and is transferable. In the court’s view, it thus shows characteristics of a property right. A claim for payment in Bitcoin is, therefore, to be regarded as a claim that qualifies for verification,”

It is now apparent that with the passing of this judgment, governments across the globe have finally started to recognize the potential use of digital assets in contractual agreements. This ruling sets a precedent which needs to be followed by other nations even though a lot still has to be done to make alt-currency adoption easier. Things are certainly looking up for the crypto community at large with crypto assets like Bitcoin currently being treated at par with fiat currencies.

Venezuelan Cryptocurrency Trade Banned in US After Trump Signs Executive Order

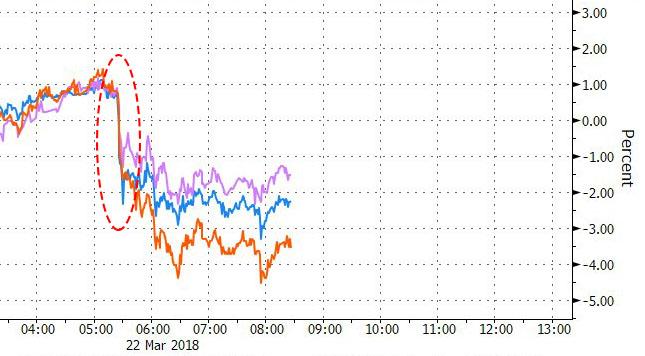

President Donald Trump, during last week, signed an executive order which bars transactions that are made inside the US involving “any digital currency, digital coin or digital token” issued after January 9 by the Venezuelan government. The order is applicable to any individual living in the US and all the citizens of the USA. The entire crypto sector instantly dropped by 3-5%, even though the Executive order has nothing to do with Bitcoin or any other cryptocurrencies. However, the fall could be attributed to the concerns that any kind of cryptocurrency might fall in Trump’s sight next.

In his statement, Trump said that “I have authorized the Secretary of the Treasury [Steven Mnuchin], in consultation with the Secretary of State, to take such actions, including promulgating rules and regulations and to employ all powers granted to the President by IEEEPA [International Emergency Economic Powers Act] as may be necessary to implement this order,” The statement specified that the term “Government of Venezuela” also includes “any political subdivision, agency, or instrumentality thereof, including the Central Bank of Venezuela and Petroleos of Venezuela, S.A. and any person owned by, or acting for or on behalf of, the Government of Venezuela.”

Binance to Open Exchange in Malta after Crackdown by Japanese Regulator

Over the past few weeks, Binance has been in the headlines constantly, starting with the hacking attempt, then over the bounty program and followed by the announcement of DEX or decentralized exchange version of Binance. The most recent being that Financial Services Agency (FSA) of Japan, as reported by Nikkei, would serve Binance with a compliance warning, which was called as “irresponsible journalism” by CEO of Binance, Changpeng Zhao.

However, he later confirmed via Twitter that the firm was served with a “simple letter” from FSA and would “find a solution”.

{The crypto markets can swing quickly, as you can see by comparing our Feb news to today’s update.}

It must also be noted that Binance is looking to open an office in the Mediterranean country of Malta. In an interview with Bloomberg, Changpeng Zhao told that he is confident that the firm will be able to announce a partnership with a bank based in Malta with an aim to launch a fiat-to-cryptocurrency exchange. He said, “We are very confident we can announce a banking partnership there soon,”. Further, he stated that “Malta is very progressive when it comes to crypto and fintech.” According to Joseph Muscat, the Prime Minister of Malta, the move from Binance to move to Malta comes as the country aims to become the “global trailblazers in the regulation of blockchain-based businesses and the jurisdiction of quality and choice for world-class fintech companies.”

{US tax return deadline is fast approaching. Need help? Start here.}

In a separate post on Binane’s blog, Zhao stated that “After meeting with Parliamentary Secretary, Mr. Silvio Schembri, we were impressed by the logical, clear and forward-thinking nature of Malta’s leadership. After reviewing a proposal bill, we are convinced that Malta will be the next hotbed for innovative blockchain companies and a center of the blockchain ecosystem in Europe. Binance is committed to lending our expertise to help shape a healthy regulatory framework as well as providing funds for other blockchain start-ups to grow the industry further in Malta.”

Yahoo Japan to Launch Crypto Exchange in 2018

Yahoo Japan is reported to take a 40% stake in BitARG Exchange Tokyo, according to Nikkei Asian Review, next month. The ultimate plan is to build a new exchange in about a year’s time using the technology of BitARG. The report also stated that BitARG already has a license from the Financial Services Agency (FSA), the Japanese financial regulator and is expected to receive additional investments from Yahoo Japan by the year 2019. Yahoo Japan is expected to use its subsidiary named YJFX, a forex transaction platform to purchase the shares in BitARG. Nikkei reported that the cost of buying 40% stake would cost the firm about $19 million or 2 billion yen.

A team from YJFX, after the purchase, is expected to bring in the development of the new exchange design systems for customer management, corporate governance, and security. The move by Yahoo Japan shows the significance of registration with the FSA to conduct operations of an exchange in Japan and the issues being faced major Binance exchange. As stated earlier, Binance, the Hong-Kong based exchange has received a warning from financial watchdog regarding its lack of registration in the country. The FSA has been cracking down on domestic crypto trading platforms which are yet to be registered and mandating security overhauls since the $533 million hack of Japanese exchange Coincheck in January.

The Cryptocurrency Forums is growing in 2018. Register for a free account using this link and join the discussions. No email marketing, spam or newsletters.

Join our discussion on this market downturn in our latest forum thread on crypto markets.