SEC Warns about Unregulated Exchanges

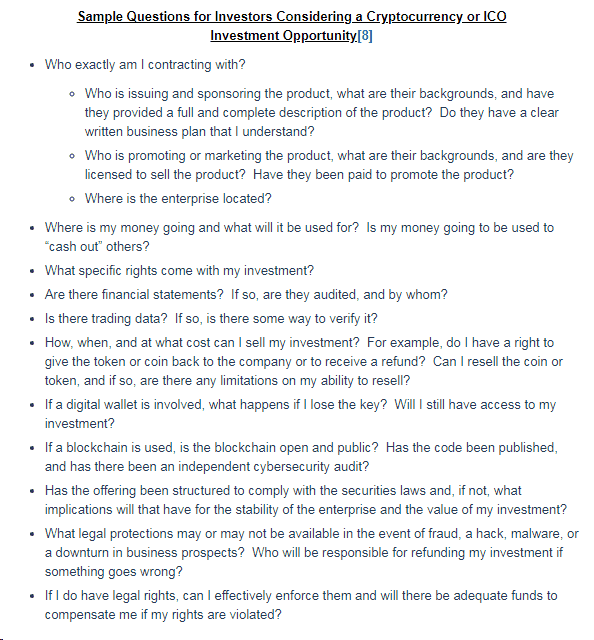

A warning has been issued by the US Securities Exchange Commission on cryptocurrency exchanges. The SEC said that most of the exchanges can do whatever they want with the money of the investors as they are currently unregulated. They warned that the companies running an exchange must expect a crackdown soon and the investors must be extremely careful. The SEC assumes that the tokens and cryptocurrencies offered by means of ICOs are securities. Hence, as a security, the cryptocurrency exchanges must follow similar rules like every exchange. The exchanges must register themselves as a national securities exchange either as a broker-dealer or as an alternative trading system (ATS) through the SEC.

However, the current situation was termed as a mess by the SEC and wrote “The SEC staff has concerns that many online trading platforms appear to investors as SEC-registered and regulated marketplaces when they are not,” and also stated that “Many platforms refer to themselves as ‘exchanges,’ which can give the misimpression to investors that they are regulated or meet the regulatory standards of a national securities exchange.”

Cryptocurrencies are Commodities, Rules New York Federal Judge

US District Judge, Jack Weinstein of the US District Court for the Eastern District of New York, in a 6 March 2018 Memorandum & Order, ruled that the CFTC has the standing to bring a fraud lawsuit against CabbageTech, Corp (majorly known as Coin Drops Markets) owned by the New York resident named Patrick K. McDonnell. The judge also ruled that “virtual currencies can be regulated by CFTC as a commodity” and stated “virtual currencies are ‘goods’ exchanged in a market for a uniform quality and value… They fall well within the common definition of ‘commodity’.”

The court was faced with two main questions, namely, whether CFTC could “exercise its jurisdiction over fraud that does not directly involve the sale of futures or derivative contracts” and if it can regulate cryptocurrency as a commodity and the answer to both questions was an affirmative.

{US tax return deadline is fast approaching. Need help? Start here.}

Japanese Regulators Suspending and Cracking Down a few Exchanges

A number of cryptocurrency exchange operators are likely to be penalized by the financial watchdog of Japan for not preventing money laundering and not taking sufficient steps to protect customers. It is expected that the Financial Services Agency might order a few exchanges to suspend its operations and warn others to shape up or risk further punishment. An official statement from the Financial Services Agency is expected to be out soon.

Prompted by the January 26th incident wherein an approximate of $550 million or 58 billion yen in the NEM cryptocurrency were stolen from Coincheck (Tokyo based exchange), the FSA is carrying out an on-site inspection at the exchange operators. Even though the inspection is not yet complete, the agency fears another Coincheck-style hack as the inspections have seemingly observed enough issues with respect to anti-money laundering and customer protection measures. Hence, it can be observed that Privacy coins are rapidly gaining attention from mainstream crypto investors. To know more about different Privacy coins available in the market, check this article.

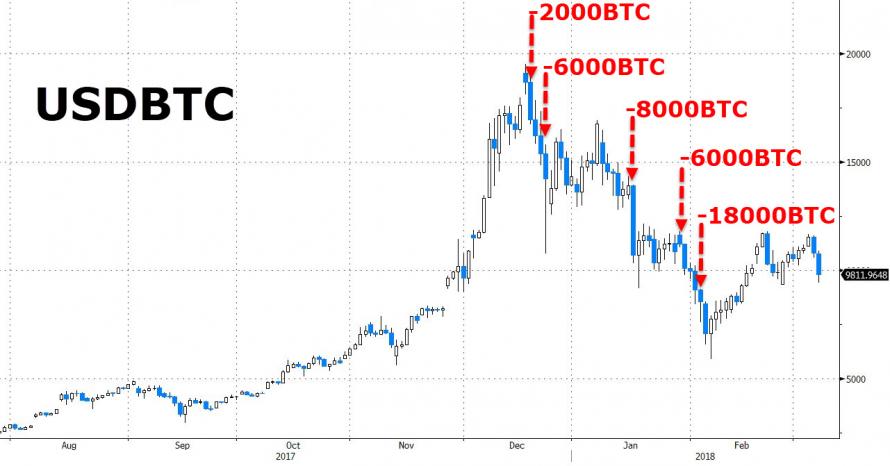

Panic Selling by MtGox Trustee pulled Bitcoin prices Down

During 2018, the prices of Bitcoin fell as low as $6,000 and according to reports, the reason behind the same was “panic selling” by a Mt.Gox trustee who sold about $400 million worth of bitcoins. From March 7, multiple news outlets reported that in order to pay the defunct exchange’s creditors, Nobuaki Kobayashi sold over 34,000 BCH (Bitcoin Cash) and 35,000 BTC (Bitcoin).

With each individual sale seeming to move the Bitcoin market lower, the sales occurred through an exchange. It was confirmed by the CEO of Mt.Gox, Mark Karpeles that the transfers occurred from December till February.

Alistair Milne, an entrepreneur reported on Twitter on March 7 that Kobayashi had transferred about 18,000 or a $180 million worth of Bitcoins the day before the prices hit a low of $5,900 on February 6. Matt Odell added that Kobayashi himself related the selling practices at the creditors’ meeting the same day. He commented that “They (the trustees) panicked and sold the bottom. Market absorbed it well”.

{Interested in buying bitcoin at the current lower price but not sure how to start? Check out our quick Buying Bitcoin Guide.}

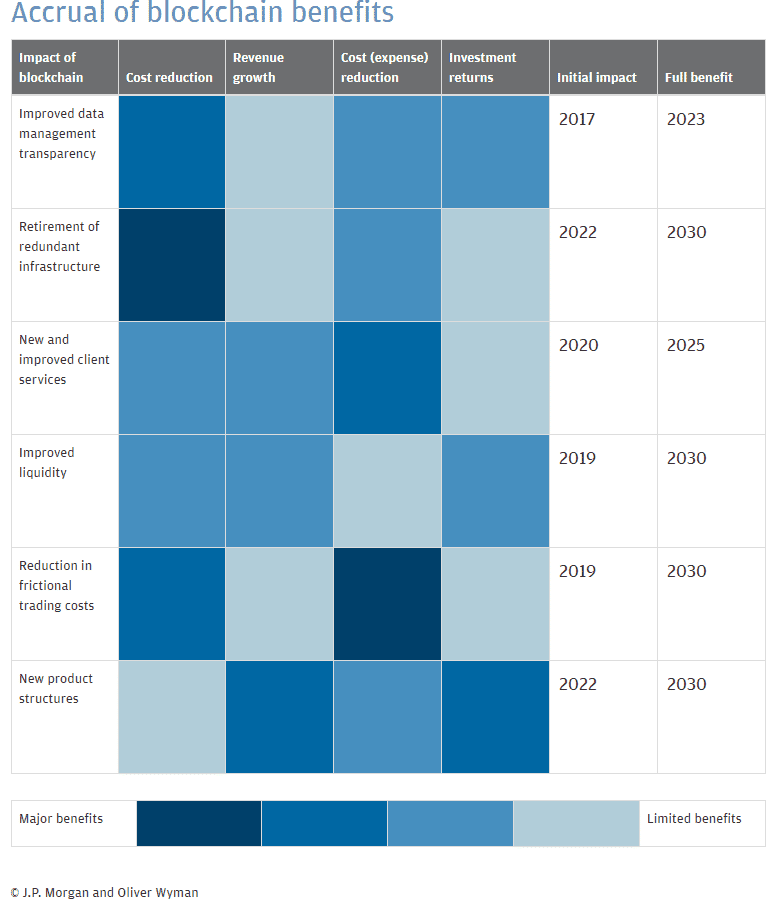

JP Morgan released Crypto Report for Asset Managers

JP Morgan, in a recent report titled “Unlocking Economic Advantage with Blockchain: A guide for asset managers,” explains about the use of blockchain in asset management and legacy business and also includes the take of the bank on adoption timeline of the blockchain. The report states “There is a growing realization that distributed ledger technology — popularly known as blockchain — will bring a radical shift in the way we think about financial assets and the way the financial industry will operate in the future,” Oliver Wyman, the co-author and the management consultant argues “ that asset managers need to get off the sidelines and take the initiative to understand and embrace blockchain.”

JP Morgan, as such presents “a guide to how the technology may evolve, the impact it may have on asset managers and the action they can take.” The guide’s first section provides detail about the “Four Anticipated waves of blockchain deployments”. The report further discusses about the benefits offered by the blockchain to the asset managers which includes frictionless data management and solutions.

It must be noted that JP Morgan, back in February said that one day, cryptocurrencies could be an integral part of a well-balanced and diverse financial portfolio. However, it announced last week that, cryptocurrencies pose a threat to their financial model. A sea-change of sentiment from an organization whose CEO regarded crypto as a fraud last year, the institution is now fully vetting the possibilities of blockchain to business entities and asset managers.

{The crypto markets can swing quickly, as you can see by comparing our Feb news to today’s update.}

However, he recently withdrew his statement and endorsed blockchain for the potential wealth it holds. The endorsement is expected to legitimize crypto to its skeptics as it comes from one of the most respected and largest financial institutions across the globe and the reports serve as a physical testament to its increased interest in cryptocurrencies and blockchain.

The Cryptocurrency Forums is growing in 2018. Register for a free account using this link and join the discussions. No email marketing, spam or newsletters.

Join our discussion on this market downturn in our latest forum thread on crypto markets.