Twitter @hodor7777 Blog link

The human mind doesn’t deal well with large numbers.

When we talk about “quadrillions” of dollars in the market for SWIFT and other international remittances, the scale of the value transfer is difficult to grasp. In addition to the sheer scale of the value being moved, consider another factor – a factor that many economists and central banks have long been unhappy with:

It takes too long.

When money is in transit for days at a time while banks rely on “hours of operation” across the globe, the capital is, in essence, removed from the money supply. Only when the transaction is clearly settled can the money then be used again for a new purpose. Economists are critically interested in this, from the IMF, to individual countries’ central banks, even to the local economies that benefit from a higher velocity of money.

Brad Garlinghouse used an example during a recent interview with Sam Maule from Fintech Insider during the SWELL Conference.15 He indicated:

“Truly the most efficient way for me to get money to London today would be to go and buy a ticket at the airport here in Toronto and fly it there. That’s a crazy thing. I mean, I can stream video from the space station, yet I can’t move my own money from point A to point B efficiently…”

This example is a dramatic anecdote that underscores how broken the current value transfer system is when attempting to meet the expectations of consumers and customers.

Already, over 70 banks are currently using Ripple software in production to solve many of the problems obstructing real-time settlement. xCurrent enables banks to go from days to real-time. In addition, Ripple created a fintech innovation that enables any organization or individual to transform value from one currency to another using a digital asset, XRP.

How Ripple & XRP Saves Banks Money

Ripple is very matter-of-fact about why banks, financial institutions, remittance services, large businesses, and even the government will want to use XRP:

It will save them a huge amount of money.

In the end, it’s this value proposition that underpins the ultimate adoption of XRP. Later on, I’ll cover some of the current challenges that banks might have using a digital asset, but for now, lets cover the reason why using one – specifically XRP – will be so beneficial.

The Current Global Payment Infrastructure is Not Meeting Demands

It’s 2017. We can share information with any part of the world in seconds. We can livestream sportscasts to our iPad. Yes, we can see the latest cat video on YouTube while sitting in an airline terminal. The examples of how fast and freely information flows in the modern world abound, and it has changed our life for the better.

Is it any wonder that people want to be able to send money in real-time?

If a person working in the United States wants to send money to their family in Mexico or another country, they must get it there using an electronic service. Currently, that process can take days if they go through a bank. So let’s break down why the current correspondence banking model is so slow. Ripple has studied the reasons in depth, and lists four1 main problems:

- No Direct Access: Small players must rely on big players due to the costs of overcoming barriers to entry. The big players are known as the “correspondence banks.”

- Lack of Certainty: The routing of payments and messaging is often broken apart, with multiple intermediaries routing payments. This leads to errors, unpredictable exception processing times, and poor visibility into individual transactions and liquidity.

- Slow Speed: Time to process depends on the currency corridor. Each leg of processing requires partner banks to be “online” and available; differences in time zones exacerbates this issue.

- High Cost: Banks must absorb significant costs of treasury operations, payment processing, liquidity maintenance, FX, and compliance.

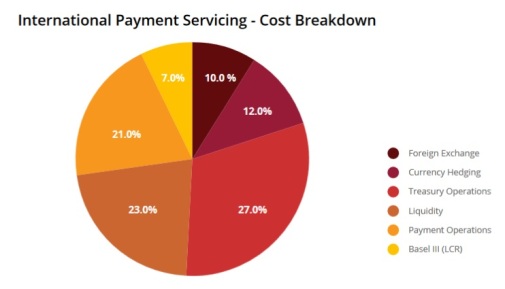

From the banks’ perspective, the costs of money transfer can be broken down into the following categories:

These costs are present in today’s system. The innovation of a digital asset has the potential to completely transform this model!

Role of a Digital Asset

This is the part of the story that a lot of new XRP investors don’t understand. In other words, they typically want two questions answered:

- Why use a digital asset?

- Why use XRP?

The answer to both questions is a part of the innovation itself. In a nutshell:

“Digital assets are cryptographically-secured tokens that hold value and can be transferred between two parties without the need for a central counterparty. As a counterparty-less asset, they can facilitate easier and more scalable provision of FX liquidity without expensive operational costs, such as opening and maintaining many bank accounts.”

Although an oversimplification, this explanation strikes at one of the central causes for high costs that banks face in the current cross-border value transfer infrastructure: maintaining liquidity in various banks and countries, and the costs associated with doing so.

Understand that for large banks and financial institutions, this savings could very well translate into billions of dollars. As a reference point, keep in mind that just one well-known service provider – Citi GTS – processed $3 trillion in daily transactions in 2015.2

Cost Savings with XRP

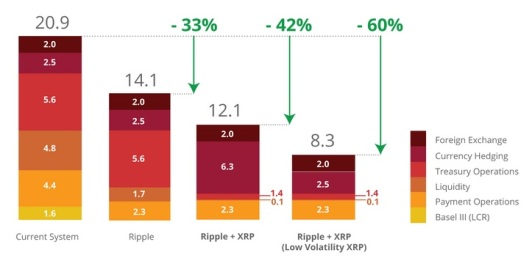

The costs savings available to organizations using Ripple technology alone (even without XRP) are considerable.

However, to achieve the biggest cost savings – up to 30% more – businesses must be willing to utilize XRP as a bridge asset for payment processing. This relationship between levels of cost saving and the usage of XRP is shown in the following3 diagram:

XRP was Created Specifically for This

So Why XRP? Why not Bitcoin or Ethereum? It’s a question commonly asked in various crypto-currency forums and discussion groups. The answer has two parts that are both important, but for separate reasons:

- Performance & Scalability

- Liquidity

When you examine various crypto-currency options available in the market today, none have been created by a US-based company except for one: XRP. It was designed from the start to facilitate global value transfer across borders, and can transform any fiat currency into any other.

Performance & Scalability

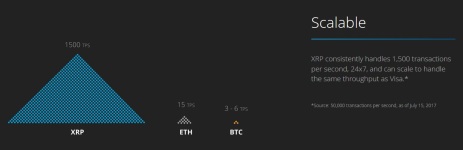

While Bitcoin has become known as a sort of “digital gold,” and Ethereum is lauded for its flexibility in creating smart contracts, neither one can come close to boasting the performance and scalability metrics of XRP.4

Liquidity

The liquidity for XRP, along with the other top choices in crypto, is growing substantially day after day. XRP volume has broken the $2 billion per day mark in August, and has exceeded $1 billion per day on various occasions. The average per day volume is growing, with the latest three-day average over $100 million:

Bitcoin and Ethereum not only boast comparable volume numbers; they exceed them. However, liquidity also has another potential element – that of Ripple’s ability to augment banks’ liquidity with its own.

Ripple, as a company, holds approximately 60% of the XRP in existence. Because of this sizeable treasury, it’s able to lend XRP or otherwise bootstrap the liquidity of banks and other financial institutions.

While specific bank deals are typically covered by non-disclosure agreements, Ripple Chief Cryptographer David Schwartz (also known as “JoelKatz” on social media) had the following to say when asked about why banks would prefer to use XRP5 over Ethereum:

“Ripple holds 60% of the XRP supply and has the ability to use as much of that as is needed to bootstrap the liquidity to target that use case. It’s hard to imagine anyone spending huge amounts of their own money to do that for Ethereum. If you just need a pool of liquidity, and someone else is building it, why should you pay to build it?”

It’s a rhetorical question; Ripple is not only building the software that banks can use to leverage XRP to lower costs – they are also able to supercharge the effort with their own large holdings of XRP.

Growing Liquidity Behind XRP

The usage of XRP as a bridging asset appears to be heading in the direction of sourcing liquidity with high-volume exchanges.

xRapid’s Potential Use of Exchanges

Recent developments indicate that xRapid or even other Ripple solutions could easily integrate with high-volume exchanges to provide the liquidity needed to complete currency-pair transformations. In other words, to access the fiat necessary to complete a transaction, an organization might be able to source the liquidity and ultimate ForEx prices at specific exchanges.

How will this access to high-volume exchanges be handled within xRapid? While the details remain internal to Ripple at the moment, excitement is brewing with the possibility that institutional use of XRP as a bridge asset will also potentially directly benefit exchange volume.

While Cuallix is already using xRapid in production to handle remittances to Mexico, xRapid was used in October in a transaction test by Ripple.6 This test utilized liquidity on Bitstamp and Bitso to complete the transaction.

Ripple’s Competition

Who is competing with Ripple? It’s not clear. While there are some other platforms and solutions that offer value, none of these offerings can approach the unique openness and future thinking that the Ripple suite of software provides.

Ripple allows banks to go at their own pace – if banks want to access significant cost savings without using a digital asset, they can certainly do that using ILP and messaging components found in Ripple’s xCurrent System.

And then, if banks wish, they may start to use xRapid for some inefficient corridors.

R3

Other solutions such as R3 reflect backwards thinking. The R3 team has constructed Corda, a smart contract solution. It doesn’t use a digital asset, and its use assumes that other banks have also “joined with R3,” a dangerous and perhaps fatally flawed assumption. It also seems to imply that banks dispense with their own ledger and instead opt for Corda.8 This is a key difference with Ripple. Ripple doesn’t assume that banks will want to give up their own ledgers.

In addition to potentially creating yet another “island” of banks, R3 also does not use a digital asset. While some banks might find solace in the simplicity of this approach, the better strategy would be to utilize XRP and see for themselves just how much it can save.

A new version of Corda was recently released in early October. While R3 itself has claimed that some banks have used the technology for “live transactions,” it’s unclear whether R3 currently has any banks using their software in production.9

SWIFT GPI

SWIFT GPI’s biggest boast lately has been to brag about how – in some instances – they may be able to speed up settlement to “same day.” Note that they even put a caveat with that point 7:

If there’s any more proof that you need that SWIFT is completely out-of-touch with modern expectations for information flow and real-time processing, it is their statement bragging about same day settlement.

While GPI certainly improves on SWIFT’s archaic and inefficient correspondence banking approach and messaging, it doesn’t do anything to bring international payments to a level that is desired by the IMF, Central Banks, and most importantly, bank customers.

The world is demanding real-time payments, and will simply not accept SWIFT’s complete inadequacy any longer.

Dis-intermediary Applications

You may have noticed a number of new mobile payment applications springing up for end-users. These applications, such as Venmo, Apple Pay, and others serve to offer a very compelling front-end and even instant payment processing for end-users.

These applications, while appearing to offer instantaneous settlement, actually just “kick the can” down the road to a normal, batched, nightly or intraday settlement process by participating banks and businesses. They are not really real-time, and there is still very much a settlement risk that these large applications are merely avoiding.

Because Ripple is building the new “plumbing” of real-time settlement, these applications may be reconfigured at some point in the future to point to Ripple software for real-time settlement of the online transaction. This would dramatically increase profits and lower risk for the businesses that are developing and deploying these mobile payment applications.

Obstacles to Adoption of XRP: Banking and Other Regulations

The SWELL conference served to solidify Ripple’s position as the next generation of real-time payments. It also was a generational statement of transition – from a legacy organization like SWIFT – to a new technology company that is re-plumbing international payments; Ripple.

When it comes to innovation adoption, the stages of technology maturation and usage have been studied in depth by researchers. Ripple is very aware of this scientific methodology, and is also in-touch with banks’ concerns, preferences, and obstacles when it comes to implementing blockchain technology. After all, they have over 75 customers using their software in production.10 11

SWELL’s Panel Discussions

During SWELL, one of the panel discussions centered around the banks that have been a part of adopting Ripple technology ahead of the pack. The panel was entitled “First Movers Tell All” and involved representatives from banks in India, Japan, and Europe.

During this session, a question was posed by an audience member:

“I’m quite interested to know: What are the drivers and restraints in adopting XRP as a bridge currency?”

A panelist from Sweden’s SEB bank went first, and admitted that her bank had not yet used Ripple for switching currencies, but was using it for messaging at the moment. Then another panelist spoke up12; Richard Bell, Blockchain Innovation Lead for Banco Santander:

“The question is not a technical discussion; the question is more more complex than that, and it has to do with regulation…”

While this answer is an example of how banks are, in parallel, struggling with some of the basic questions around crypto-currency, it also serves to demonstrate an opportunity. Banks are in need of guidance, and so are governments.

Understanding of Regulation is an Obstacle for All of Crypto

The example from SWELL’s panel discussion of First Movers centered around banks’ adoption of XRP, but it’s wise to elevate the discussion above just one digital asset, and instead take a more high-level view of financial laws and rules, and the need for clear approaches from various governments and regulatory organizations.

At the latest Ethereum conference – dubbed “Devcon 3” – one of the first panel discussions involved the topic of regulation. Jerry Brito, Executive Director of Coin Center, was one of the presenters.

Coin Center is a nonprofit crypto-advocacy organization. It’s goals are to educate policymakers and the media, research policy and develop smart regulatory approaches, and to advocate for blockchain technology. 13

United States

Over the past two years, Coin Center has been working with the Uniform Law Commission to develop a “model state act” for regulation of crypto-currency based businesses in the United States. This would supplant the current money transmission licenses offered in each state, such as the “bit license.”14

The model act contains some exciting potential changes from existing regulation:

- You only need a license if you “take control” of somebody’s crypto-currency

- Selling of new tokens that you personally create doesn’t require a license

Coin Center’s goal is to obtain passage of this new law in as many states as possible.

In addition to the long-term goal of the model act, Coin Center is also working with the United States’ SEC to clarify the interplay between cryptographic tokens and what are considered “securities.”

While China placed an immediate hold on all Initial Coin Offerings (ICOs), the United States’ SEC sought to offer guidance on the matter by providing a working definition of when a token involved in an ICO should be considered a security in their eyes. Jerry Brito indicated that the guidance from the SEC echoed the thoughts and communications that Coin Center has had with that organization.

Global

Europe is drafting its 4rth Anti Money-Laundering (AML) directive. This affords the opportunity to clarify specific aspects of definitions contained within these regulations, including the definition of control of crypto-currency. The goal is to standardize the “control” test not only for the United States, but globally.

The definition of control is important, because it has the potential to clearly separate the laws and regulations, simplifying much of the guidance so that individuals can continue investing in – and using – crypto-currency without hesitation.

Coin Center supports KYC procedures being under the umbrella of each exchange. This approach makes practical sense, but I still wonder if the topic of anonymous wallets (or anonymous crypto-currency itself) has really been dealt with, or just ignored until a body of judicial rulings accumulates.

Banks Need Clear Guidance

Ripple is now standardizing usage of xRapid, which involves banks using XRP as a bridge asset. This solution has already seen its first production usage. Parallel to the announcement of Cuallix’s adoption of xRapid, Ripple announced the RippleNet Accelerator Program, which will reward those banks and other financial institutions that step forward to lead the charge in using a digital asset.

These steps indicate that Ripple stands ready to streamline the usage of XRP with clear and consistent boundaries and guidance – an integral and necessary part of assuring their conservative bank customers that they can easily navigate regulatory conformance.

Ripple Will Continue to Lead From the Front

In one recent article, Shanna Leonard from Ripple wrote about “Nine Things You Need to Know About XRP,” and it’s one of those points I will highlight here:

“It’s a question of WHEN, not IF, banks and other financial institutions begin using digital assets in their day-to-day business operations and it will be interesting to see who the winners and losers in the digital asset space will be. We are confident that XRP will succeed because it has a purpose – enabling financial institutions to send money across borders quickly, cheaply, and easily – that is relevant to businesses and consumers everywhere.”

While there are many reasons for businesses to use a digital asset, banks will find the cost-cutting associated with XRP to be the most persuasive of reasons. As for me and my fellow XRP investors, we’ll be content with our returns on this industry-leading digital asset. ![]()

Sources

- https://ripple.com/files/xrp_cost_model_paper.pdf

- https://www.citigroup.com/citi/investor/quarterly/2016/ar15c_en.pdf

- https://ripple.com/insights/ripple-and-xrp-can-cut-banks-global-settlement-costs-up-to-60-percent/

- https://ripple.com/xrp/

- https://www.xrpchat.com/topic/6233-ripple-vs-ethereum-not-the-price-but-the-merits/?do=findComment&comment=59437

- https://www.credit-suisse.com/pwp/ws/videobroadcast/?pid=9ceVakBGCElMdKCKL5I4T6_prgxnKHap (20:45 forward)

- https://www.swift.com/our-solutions/global-financial-messaging/payments-cash-management/swift-gpi#

- https://xrphodor.files.wordpress.com/2017/11/72030-corda-introductory-whitepaper-final.pdf (page 3 – Section 2 Context second paragraph)

- https://www.reuters.com/article/us-r3-blockchain/bank-backed-r3-launches-new-version-of-its-blockchain-idUSKCN1C80MS

- https://ripple.com/

- https://www.americanbanker.com/news/inside-ripples-plan-to-make-money-move-as-fast-as-information

- https://ripple.com/insights/live-swell-first-movers-tell/3/ (32:33)

- https://coincenter.org/our-work

- https://www.youtube.com/watch?v=Yo9o5nDTAAQ&list=PL57quI9usf_vFpniR6sKwDqUdvlVoaa2T (32:30)

- https://youtu.be/wUEHQsJ4g3M (24:20)

Powered by WPeMatico