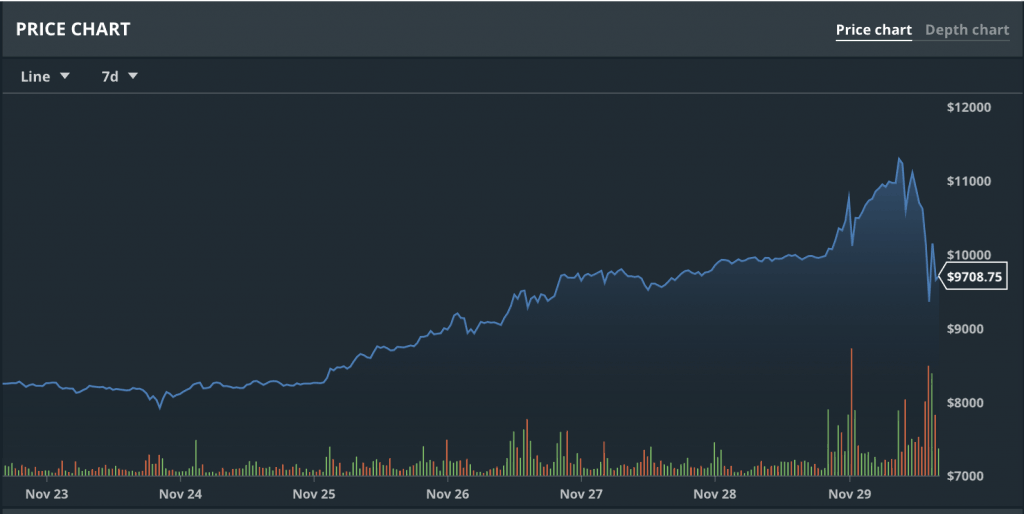

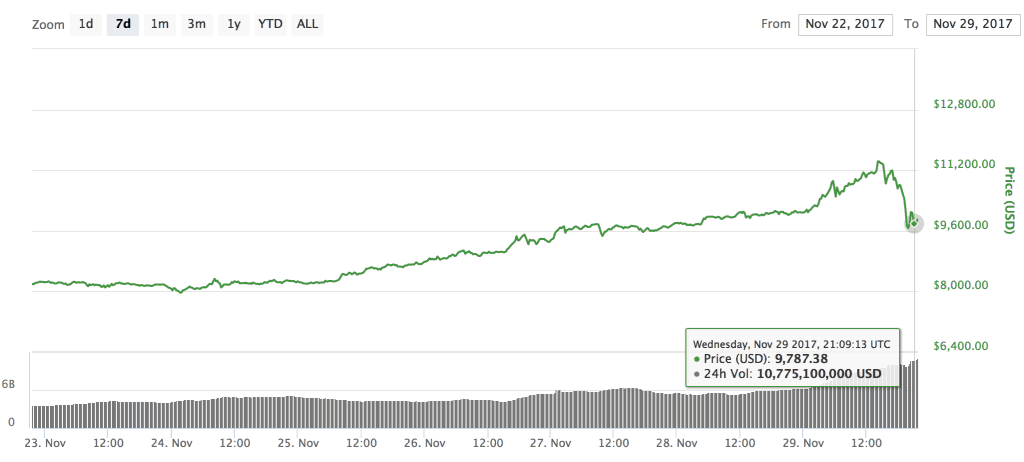

The price of bitcoin has seen both major increases and experienced precipitous declines over the last 48 hours. Investors and followers of bitcoin anxiously waited for the currency to top the $10,000 per coin point. As a major psychological price milestone, $10k was heralded by some as further evidence of legitimacy for bitcoin. During the rapid price rise, newly interested investors flooded social media sites asking how to buy bitcoin, how to set up wallets, and even the more basic question “What is bitcoin?”

New investors drive bitcoin prices higher

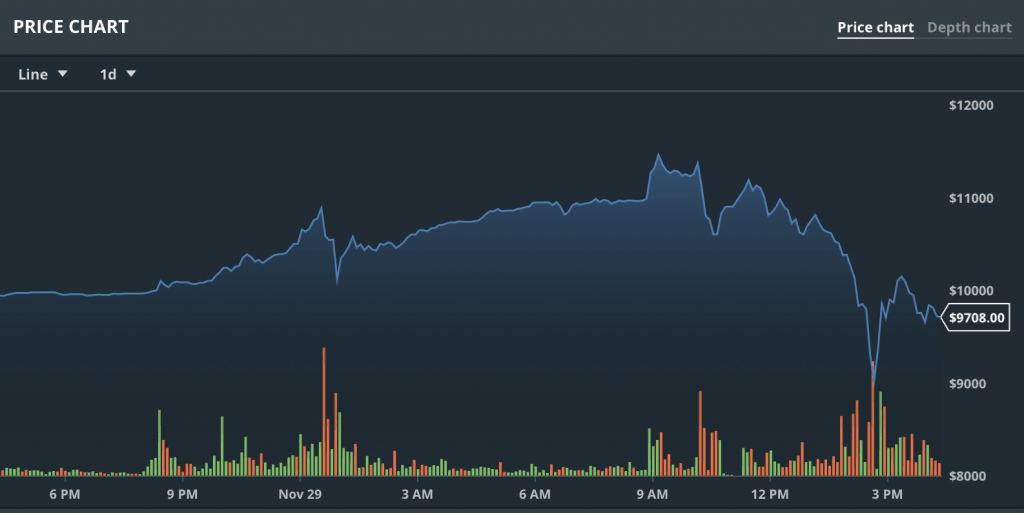

Coinbase saw another surge in account numbers over the US holiday weekend per a recent CNBC report, and they now stand at over 13 million accounts, exceeding the total number of investment accounts at Charles Schwab & Co, Inc. (Get started with Coinbase.) It is likely that new investors flooding into the markets helped bitcoin cross the $10k price threshold. Bitcoin prices continued to rise to the $11,500 mark, but this was almost immediately followed by a 20% drop to the $9,000 mark. New investors were treated to what bitcoin veterans call a “flash crash.” Many experienced cryptocurrency investors often advise investors to make no moves at all during a flash crash, or to move additional money into the market when prices drop. “Buy the dip” goes the saying.

Are new bitcoin buyers still bullish?

It remains to be seen whether new investors have the patience and the fortitude to withstand a 20% drop in their investment value in 24 hours. Panic selling can result, which can then push prices lower. Bitcoin wild price swings are nothing new, but they can certainly catch new investors by suprise. Bitcoin prices recovered quickly to just under the $10k mark late afternoon US eastern standard time, suggesting that many are content to sit on their holdings and wait. Indeed, some bitcoin investors are pointing to one large sell order on GDAX as a possible cause for the quick price decline.

Liquidity and trading volumes for bitcoin and cryptocurrencies in general tend to be thinner than other markets such as on stock and option exchanges. This means that large buy or sell orders can influence pricing to a greater degree than with other investments. Many believe large bitcoin holders, called whales in bitcoin circles, artificially manipulate prices by placing false orders to drive prices in a set direction before removing them just before they execute. It isn’t known how often or even whether this actually occurs, but it isn’t out of the realm of possibility given cryptocurrency daily trading volumes. Peak bitcoin 24 trading volume for the last 7 days ending November 29th was just under $11 billion USD. Compare that to the trillions of dollars traded daily on stock exchanges throughout the world.

What’s next for bitcoin prices?

More experienced investors and traders often take to Reddit and social media to urge their new bitcoin colleagues to exercise caution when buying. “Only buy with money you can afford to lose” is the frequent mantra. Many successful investors have noted that buying with each bitcoin price dip in 2017 has increased their returns quite a bit. This can be accomplished by moving money into an exchange and placing limit orders, by buying regular amounts on set days every week or month (dollar cost averaging) or by staring at the trading screen 24/7 watching for a price decline. We here at TCF don’t advise that last option for obvious quality of life reasons, but the first two are legitimate time-proven strategies used by stock investors for decades. Of course, past history does not guarantee future results, and the cryptocurrency market could move into short-term or long-term declines at any time.

So where do we go from here? As always, no one really knows. Be sure you fully understand that, regardless of price direction, there will continue to be major price volatility and large swings in the value of bitcoin. Volatility is the one constant that we here at TCF feel comfortable predicting. Actual prices and directions of moves? Others can make those predictions, we’re just along for the ride. Only invest what you can afford to lose. If you’re sitting on major profits, be sure to consider tax strategies and implications before making any portfolio adjustments.

As always, this article is not intended to be investing advice. TCF does not endorse any particular investment nor make investment recommendations. Material posted here is for news and informational purposes only. Always consult an expert if you need specific help with financial matters.

Thanks for reading. Happy investing.