What is LTO Network (LTO token)?

What is LTO Network (LTO token)?

LTO Network is one of the leading layer 1 blockchain platforms in Europe widely adopted by many investors. The project was created to address business issues such as decentralized workflow management, data and document verification.

In 2021, LTO Network deployed its mainnet with COBALT, expanding platform functionality by integrating Decentralized Identifiers (DID) and Verifiable Credentials (VC). These technologies serve as the foundation for developing layer 1 blockchain networks, NFT 2.0, supporting investors in owning and managing decentralized personal digital assets.

LTO Network adopts a hybrid (2-layer) approach to comply with GDPR standards (general data protection regulation) naturally, and automatically. This helps customers easily meet increasingly strict regulations and laws on privacy. Developers and businesses can build decentralized applications focusing on privacy-enhancing data availability (PADA) and access unique profit-making opportunities.

The platform currently has 93 nodes, 172 million staked coins, and over 250 thousand operations per week. On April 3rd, the MEXC exchange listed the LTO/USDT futures trading pair. Previously, House of Chimera predicted that LTO Network has the potential to be at the forefront of the RWA market by 2030.

Features of LTO Network

- Live Contracts: The project allows for the creation and deployment of live contracts between parties in real-time, ensuring investor rights.

- Hybrid Blockchain Mechanism: LTO Network applies a hybrid blockchain mechanism, combining the advantages of both public and private blockchains:

- Public blockchain provides high security through distributed nodes and reward mechanisms to incentivize node operators.

- Private blockchain is used to promote collaboration, efficient data exchange, and automate decentralized business processes RWA.

- Utility: Leveraging technology applications, LTO Network enables users to register diverse services, add or remove parties involved in live contracts, and record discussions on the blockchain. This creates a conducive environment for transactions with an intuitive, user-friendly interface.

- Multi-cryptography: The project supports multiple encryption algorithms including ED25519, ECDSA with two curves:

- ecp256r1: NIST standard, commonly used in decentralized applications similar to SSL certificates.

- secp256k1: A curve widely used in many blockchains, especially Bitcoin and Ethereum. However, it is rarely used outside the cryptocurrency world.

- Security: LTO Network fully complies with the GDPR data protection laws of the European Union. The LTO hybrid framework allows private blockchains to scale effectively while maintaining the security features of the widely adopted public blockchain. The project integrates the proof-of-stake (PoS) consensus algorithm.

Tokenomics

- Token name: LTO Network

- Symbol: LTO

- Contract: 0xd01409314acb3b245cea9500ece3f6fd4d70ea30

- Blockchain: Ethereum

- Total supply: 426,505,161 LTO

- Maximum supply: 500,000,000 LTO

- Reported circulating supply: 426,505,161 LTO

Token distribution

- Seed round: 14.3%

- Private round: 14.4%

- Public round: 7.3%

- Team and advisors: 23.2%

- Incentives: 11.9%

- Foundation: 11%

- Ecosystem: 17.9%

Price movement and exchange

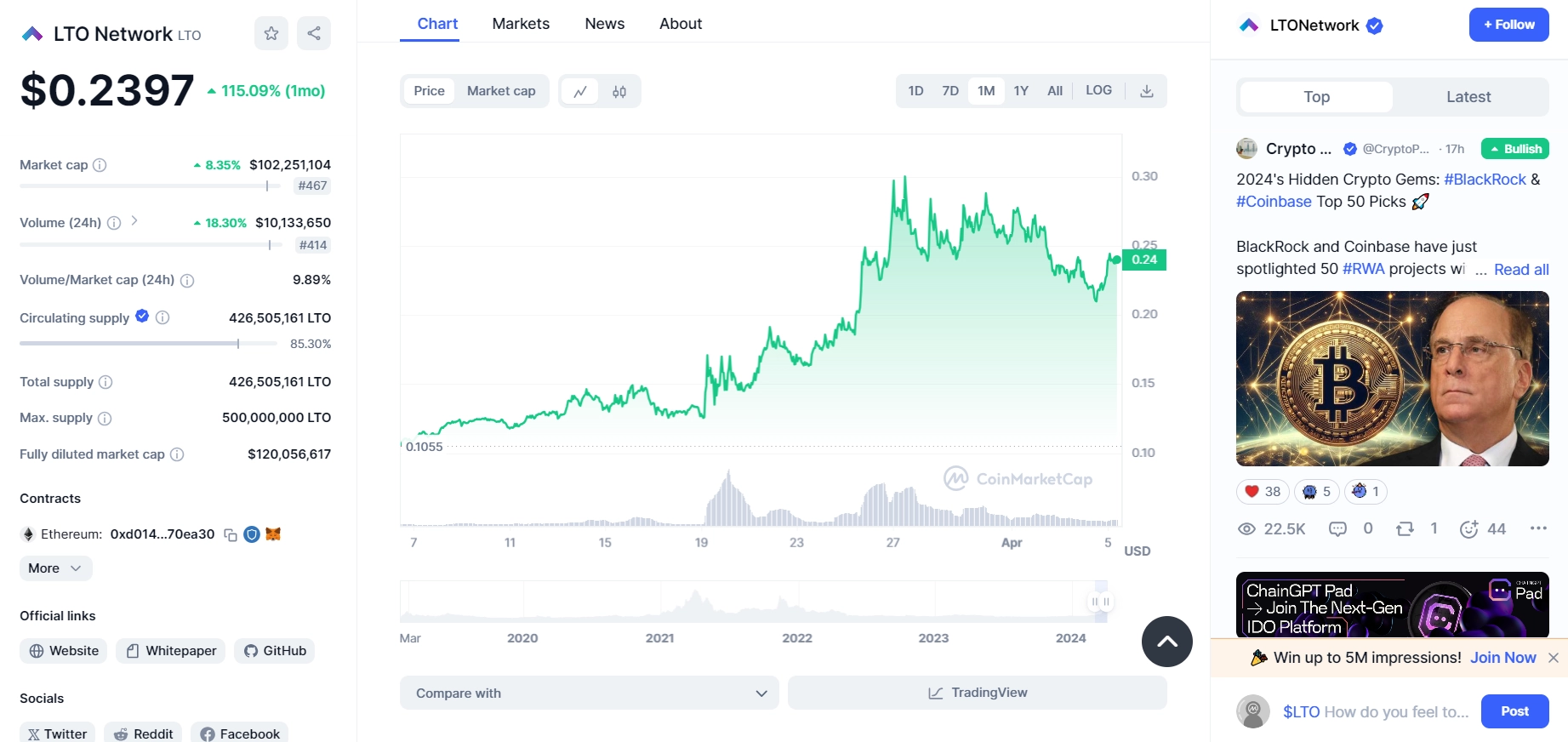

The LTO token of the LTO Network is trading at $0.2397, up 115.09% in the past month. According to CoinMarketCap data, the platform's 24-hour volume is $10,133,650, up 18.3%. The project's market capitalization stands at $102,251,104, up 8.35%.

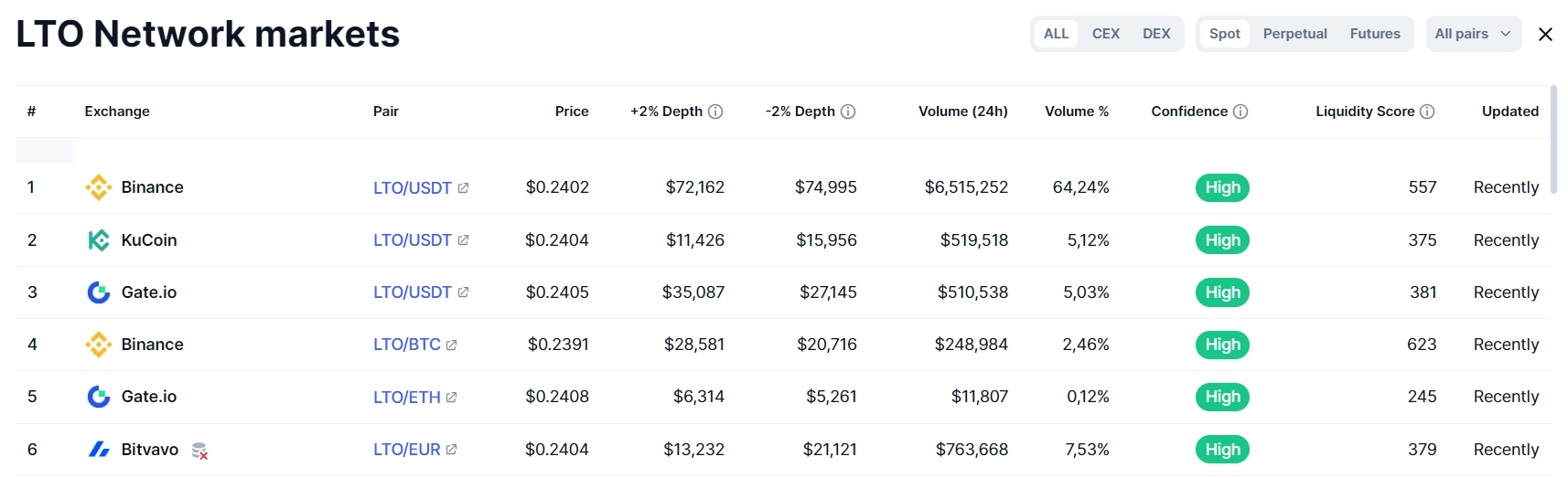

Investors can buy LTO tokens on exchanges such as Binance, KuCoin, Gate.io, Bitvavo...

Team

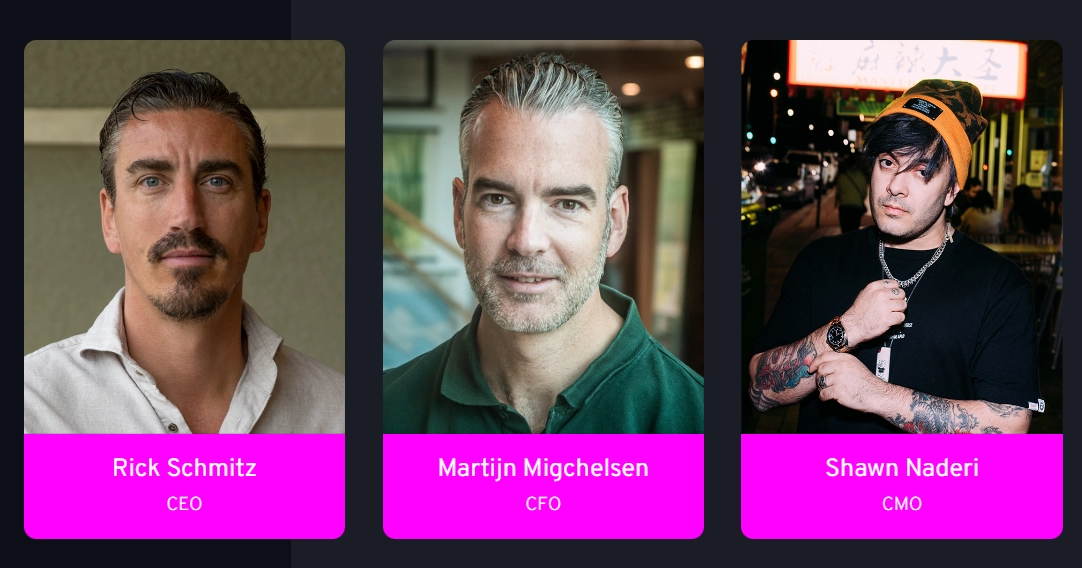

Firm24 initially developed the LTO Network under the name LegalThings One in 2014. By 2017, the team decided to incorporate blockchain into the product and renamed it LTO Network. Some core members of the project include:- Rick Schmitz is the founder and CEO of the platform. Rick is known as an experienced entrepreneur, having worked in private equity, mergers, and acquisitions at Deloitte and PwC.

- Martijn Migchelsen serves as the Chief Financial Officer, Chief Operating Officer, and one of the founders of LTO Network. Previously, Martijn worked as a corporate finance advisor at PwC.

- Arnold Daniels is one of the founders and the chief architect of the project. Arnold has extensive experience in open-source development, leading the technical team in building the platform. Before joining LTO Network, Arnold worked as a lead software engineer at Cloud9.

- Sven Stam is the Chief Technology Officer of the platform. Sven holds a master's degree in artificial intelligence and has been active in the cryptocurrency industry for over 15 years.

- Shawn Naderi is the Chief Marketing Officer of the platform, with years of experience in the blockchain market and public relations.

Roadmap

Step 1: Connect the API of the private layer with Firm24

Firm24 is one of the leading business registration notary companies in the Netherlands, providing an API-based notary platform. LTO Network integrates the private layer with Firm24's software. This allows financial institutions to issue contracts without manual intervention or through intermediaries.Step 2: Create a Plug and Play structure for RWAs

LTO Network's Ownables technology was deployed on the mainnet in December 2023. The project plans to create templates, apply Ownables to RWAs to deploy notarized contracts issued by Firm24 as immutable digital assets.The platform is expected to release the LTO Network Ownables wallet in the first quarter. The wallet supports investors in storing and managing individual RWAs. The template contains smart contract code for bidirectional integration with Firm24. This allows RWAs on the LTO Network to interact smoothly with the real world.