On March 20, Starknet listened to community opinions and reduced fees after Decun. The project announces a development roadmap for 2024 to improve performance and allow investors to limit the upgrade time. The feature most expected by users is "Parallel Execution" which will be available in Starknet version v0.13.2 expected to be released in the second quarter.

Parallel Execution is a solution used by blockchains to execute multiple independent transactions at the same time. This overcomes the limitation of Sequential Execution - only executing one transaction at a time on the blockchain.

Parallel Execution increases scalability and reduces transaction fees while maintaining EVM compatibility. Some blockchains that use this solution include Solana, Aptos, Sui and Sei.

What is Starknet?

Starknet is a layer 2 solution for Ethereum utilizing the ZK-Rollup approach. Starknet enables any dApp to operate, function, and scale without limitations while preserving the aggregation and security capabilities of the Ethereum blockchain. This is achieved through the power of the STARK system, derived from StarkWare's technology.Starknet's smart contracts and operating system are written in the programming language Cairo. It supports the deployment and scalability of DApps or smart contracts regardless of the underlying business logic.

Starknet announced the details of the STRK token airdrop on February 20th. The project stated that it would airdrop 700 million STRK to 1.297 billion eligible wallets participating in the airdrop program.

The project took a snapshot on November 15, 2023. The claiming portal opened on February 20th and will close on June 20th.

However, the event has been receiving criticism from the community due to some criteria being deemed unfit. Many Starknet users have voiced complaints about not being able to meet the criteria, especially having 0.005 ETH at the snapshot time. Regrettable cases have occurred, leading the community to criticize the project for deliberately allocating airdrops to "insiders."

After a series of negative feedback from the community, Starknet posted an article with the content: "Thank you all for speaking out in the past few days! We are listening and hearing all of you. There is much more to come, and the community comes first." The project also mentioned that for those who do not meet the criteria for this airdrop, "there will be additional terms in the future."

Previously, STRK token was listed on Binance and some other major exchanges on February 20.

Starknet's products

Starknet includes the following prominent products: Cairo, SHARP, VeeDo, Starkex, Starknet, and Starkgate.- Starkex: A streamlined version of Starknet designed for trading (Specific L2). StarkNet, on the other hand, is the full version - a permissionless decentralized ZK-Rollup.

- Cairo: A universal computational programming language used by both Starkex and Starknet. All protocols and DApps built on Starkex and Starknet utilize Cairo. However, Cairo's incompatibility with the EVM creates challenges for developers.

- SHARP: A system that aggregates Cairo Programs to create proofs for all of them and submits these proofs to Ethereum for verification by the STARK verifier, reducing transaction gas fees.

- VeeDo: VeeDo introduces trustless randomness verifiable through STARK technology, similar to Chainlink's VDF.

- Starkgate: A bridge enabling users to transfer assets between Starknet and other Layer 2 networks like Polygon, Arbitrum, and Optimism.

Starknet's ecosystem

The Starknet ecosystem consists of various puzzle pieces, with numerous projects actively developing and pushing forward.

DEX: Prominent DEX platforms on Starknet include Starkswap, Jediswap, mySwap, Zigzag, and more.

Lending: An essential aspect of any ecosystem for capital efficiency, lending opens possibilities for future applications like derivatives and leveraged farming. Lending projects on StarkNet include zkLend, Maker DAO, Aave, Curve Zero, and more.

Infrastructure: Noteworthy projects in this category on Starknet include:

- Bridge: Projects like Suez, Qasr, and Kubri are being developed to funnel funds into Starknet.

- Explorer: Supporting transaction tracking and other information visualization through charts (wallet balances, trading volume, etc.).

- Asset storage wallets for interacting with ecosystem applications, such as Argent X and Braavos, are popular.

- Infrastructure for DAOs:

- Snapshot and Zorro Protocol provide infrastructure for voting DAOs.

- Bibliotheca is infrastructure tailored for Ethereum Loot, an NFT project.

- Gaming projects on Starknet encompass Dope Wars, Influence, Realms, Game of Blocks, Eykar, Bitmapbox, Phi Φ, The Ninth.

- NFT Marketplace projects include Mint Square for NFT issuance, NFTflow for liquidity provisioning, and Briq for NFT creation support.

Other projects within the Starknet ecosystem include:

- Yield aggregator: Fuji DAO, the first yield aggregator project.

- Derivatives: ZkX, a derivatives-focused project.

- Launchpad: ZkPad, a launchpad in its initial phase.

- Betting: iBetYou, a betting project within the ecosystem.

STRK token information

- Token name: Starknet

- Symbol: STRK

- Contract: 0xCa14007Eff0dB1f8135f4C25B34De49AB0d42766

- Blockchain: Ethereum

- Total supply: 10,000,000,000 STRK

- Maximum supply: 10,000,000,000 STRK

- Self-circulating supply: 728,000,000 STRK

Use cases

- Payment of transaction fees.

- Participation in governance and voting.

Allocation

- StarkWare Investors: 17%

- Core Contributors: 32.9%

- Community Provisions: 9%

- Community Rebates: 9%

- Grants: 12%

- Strategic reserve: 10%

- Donations: 2%

- Treasury: 8.1%

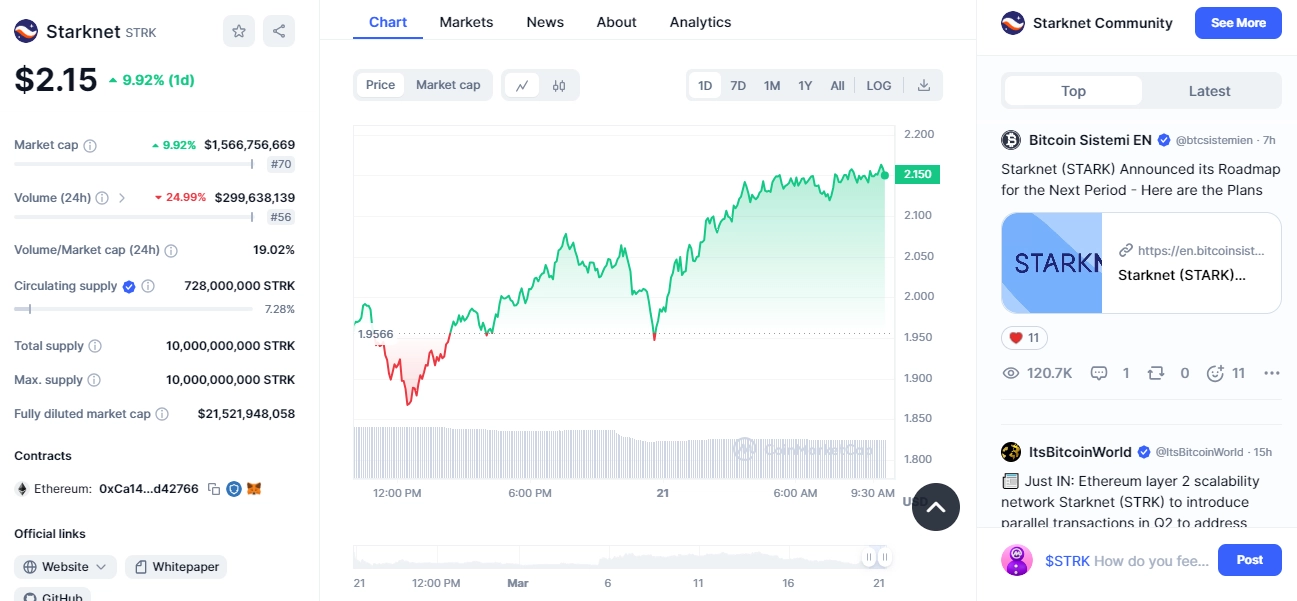

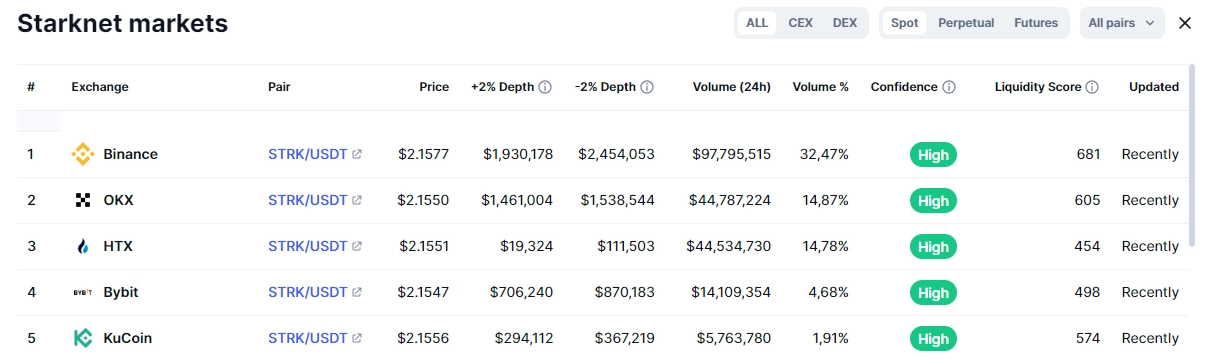

Price fluctuations and trading platforms

STRK token is trading at $2.15, up 9.92% in the past day. According to CoinMarketCap data, Starknet's 24-hour volume is $299,638,139, down 24.99%. The project's capitalization reached $1,566,756,669, an increase of 9.92%.

Investors can buy STRK tokens at most popular exchanges such as Binance, OKX, HTX, Bybit...

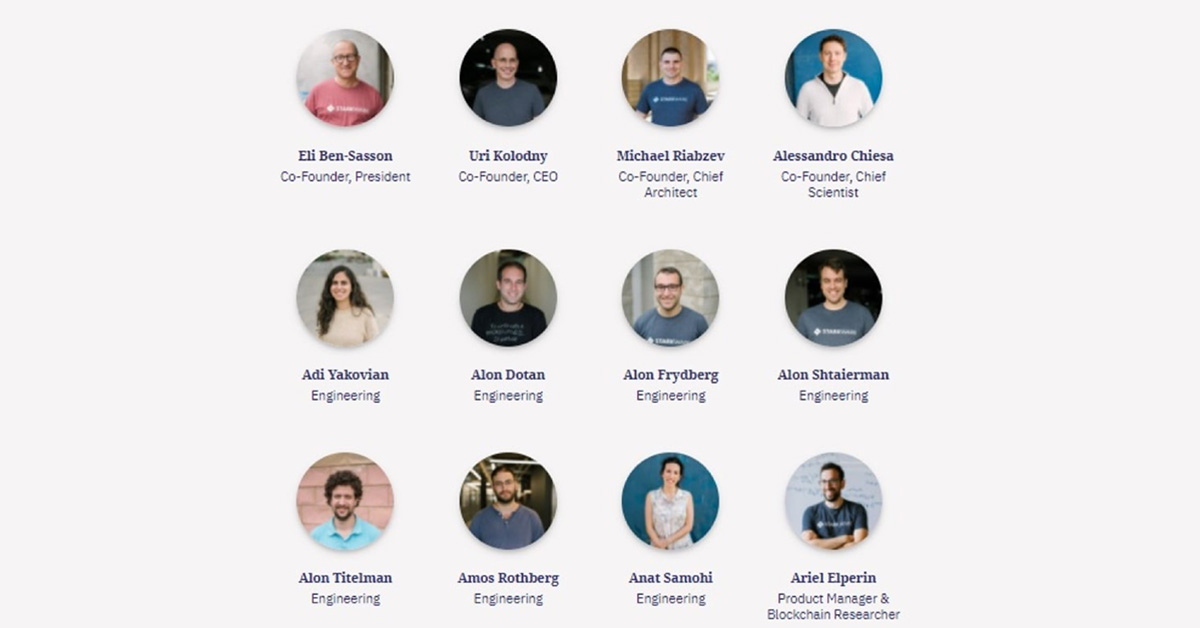

Project team

Behind the Starknet project is the StarkWare team, including:- Co-Founder & President: Eli Ben-Sasson

- Co-Founder & CEO: Uri Kolodny

Investors

Starknet's Funding Rounds are as follows:- 10/5/2018: Raised $6 million (venture capital) from Pantera, Naval Ravikant, MetaStable, Floodgate, Polychain, Vitalik Buterin, Zcash Co-founder, Arthur Breitman, Da Hongfei, Bitmain, Elad Gil, Fred Ehrsam, Linda Xie...

- 31/10/2018: Raised $30 million (venture capital) led by Paradigm, with participation from Intel Capital, Sequoia, Atomico, DCVC, Wing, Consensys, Coinbase Ventures, Multicoin Capital, Collaborative Fund, Scalar Capital, Semantic Ventures.

- 24/3/2021: Raised $75 million (venture capital) led by Paradigm and other investors.

- 26/11/2021: Raised $50 million led by Sequoia and other investors.

- 25/5/2022: Raised $100 million, led by Coatue and Greenoks.

- 1/72022: Raised $9.5 million, led by Alameda Research.

Partners

Currently, the project has collaborated with well-known names such as Infura, Consensys Ledger, Alchemy...

Roadmap

Starknet's development roadmap in 2024:- Mainnet time: Implement v3 transactions, support for EIP-4844 token and ensure network stability.

- Second quarter: Develop parity transactions.

- Quarter three: Cairo-native integration.

- Fourth quarter: Will be determined from the following factors:

- Voltion: Supports hybrid information storage process.

- Applicatve recursion: Helps strengthen data storage evidence.

- Data compression: To reduce the data footprint of Starknet on Ethereum.