Be sure to read our newest article on Coinbase Pro. We will update this post with new screenshots and specific Coinbase Pro tips at a later date. In order to use Coinbase Pro, you must first sign up for a Coinbase account.

Coinbase (our guide here) is the most popular cryptocurrency exchange in the world with over 13 million accounts as of December 2017. Its ease of use and variety of payment methods appeal to both new and veteran cryptocurrency investors. But it’s certainly not without problems. Rapid growth in the number of accounts has led to increased complaints of technical glitches or transaction problems. But probably the most common complaint about Coinbase is the high fees. When initiating a buy order on Coinbase, the user is presented with a price quote for the underlying currency that is at the top of or slightly higher than the current trading range of that currency on other exchanges, as Coinbase adds up to 0.75% to the quote.

Then come the fees. Using USD already in your Coinbase wallet, you can make an instant purchase with a 1.49% fee. The same fee applies if you make the purchase from your bank account, and then you must wait 7-10 days to receive your coins. Instant purchases using a credit card result in a 3.99% additional charge. Users are paying very high fees for the convenience of Coinbase.

Coinbase and GDAX only trade bitcoin, bitcoin cash, ethereum and litecoin. For trading other cryptocurrencies, you’ll need to use one of the other crypto exchanges.

Moving From Coinbase to Trading on CBP

But there is a better way. Using the Coinbase-owned and fully licensed exchange Coinbase Pro (CBP), you can place buy orders with fees as low as 0.10%. There are more advanced options for creating Post Only trades that essentially result in zero fees. Limit orders allow you to set the price at which you are willing to buy or sell. Perhaps you are not interested in buying bitcoin at $10,000 but you’d like to be ready to buy at $8,000. You can’t monitor your accounts 24/7. CBP Limit orders allow you to place an order to purchase whatever amount of bitcoin you wish at $8,000. The order will execute automatically if bitcoin drops to that price. You can do the same when selling with a Limit order to sell when bitcoin hits $15,000 for example. There are more advanced options for Limit orders as well.

Sounds great, so why aren’t more people trading on CBP? Some are unaware of its existence. Others may be somewhat apprehensive of the trading interface or concerned about placing trades out of fear of making a costly mistake. Those are certainly valid concerns. How can mistakes be eliminated? Always pay close attention when placing trades. Triple check everything before confirming a trade, then check again as soon as trade is placed in system. Understand all trade types before starting. And finally, read this guide until you fully understand all of the trade and order entry options.

Please note this guide is not intended as advice on buying or selling cryptocurrency. Example trades will be used throughout. These are not recommended trades nor endorsements of the traded assets. They are for educational use only. Let’s get started.

Opening a CBP Account

Getting an account with CBP is pretty straightforward. You must first have a Coinbase account fully verified and linked to a bank account. CBP requires additional account verification steps. Follow all of the instructions to open an account. This may take a few days depending on your Coinbase status. Once your account is set up, you must deposit funds before placing orders. You cannot buy with a credit or debit card on CBP. You cannot buy now and pay later from your bank. That option exists in your Coinbase account, and these conveniences come with the cost of higher fees.

Depositing money to CBP is as simple as transferring it from your Coinbase account or bank. On any of the trading screens, tap the Deposit button upper left corner. You will be presented with a tabbed menu screen where you can select currency to transfer, enter desired amounts and choose the accounts for transfer. The rest of this article assumes you have a CBP account with available funds for buying.

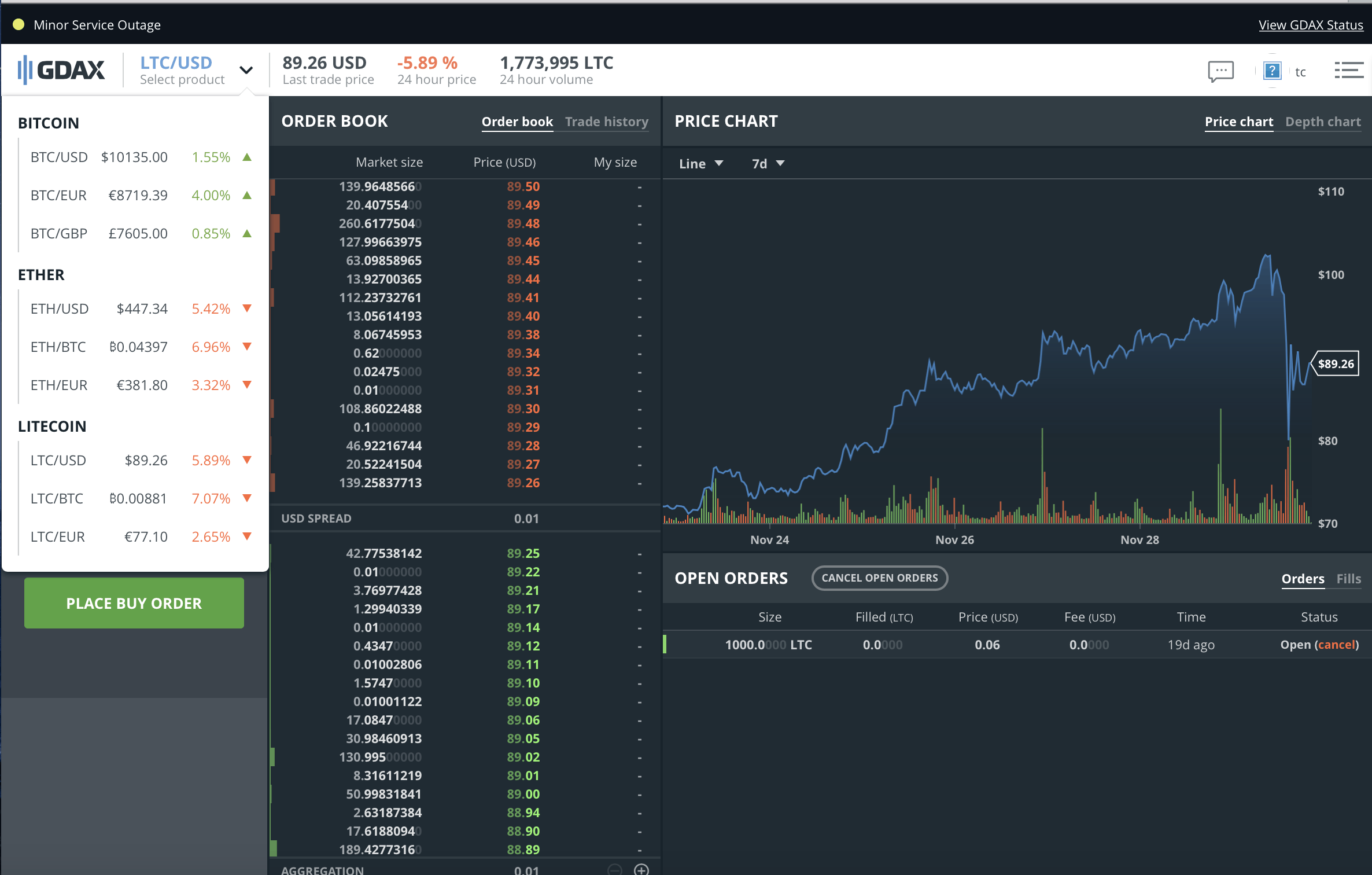

After logging into your account, you are presented with the ordering/trading interface page. This section discusses using the web page. There is mobile video example later in the article demonstrating the same order entry methods. If your screen does not look like Figure 2, navigate to the top right corner and select “Trade” from the dropdown menu (Fig. 3.) You may also wish to explore the other menu options here. You can modify your account settings, view and export trade history, and access help articles. Be sure to spend some time learning how each option works. Pay particular attention to the information under the “My Fees” heading.

Entering Buy Orders on CBP

On the top left corner, you will find a drop-down menu that allows for selection of trading pairs offered by CBP. Pairs include dollars (USD) and euro (EU) to buy bitcoin (BTC), litecoin (LTC) and ethereum (ETH.) For illustration purposes, the current trading pair selected in Fig.4 is LTC/USD. The price chart is set to show LTC prices for the previous 7 days with a line chart. You can make changes using the dropdown selection menu at the top of the screen positioned in the center, and the changes will be reflected in the chart on the right side of the screen. Notice in this screen shot that there is a current open order for LTC. This is shown in the bottom right panel of the trading screen. The order was placed as a Limit order for 1000 LTC to execute if price drops to $0.06 just for demonstration purposes. It will remain open until it fills (I can dream) or until the “cancel” option under “Status” is selected.

To place a similar order, first select the desired trading pair from the top left menu. I will select LTC/USD to demonstrate how to buy litecoin using my dollar balance. This video will demonstrate first entering an order for $500 worth of litecoin at the current market price of $100.20. For a Market Buy, you simply enter the dollar amount you wish to buy in the Amount box. If the “Place Buy Order” had been selected, the order would have immediately filled for 4.97504990 litecoins, and $500 would have been deducted from the USD balance top left. Instead, the order was erased before placing it, because I prefer Limit orders for all buys.

https://youtu.be/q3Af1LNWJuo

In the second portion of the video, note I select “Limit” and the order entry box changes. I can now specify how many litecoins I wish to purchase and exactly what price I’m willing to pay. In this video, I chose to buy 50 litecoins at $1.50 each (again, I can dream.) The total cost for that order is shown under the order entry options as $75. Once the order is placed, it appears on the bottom right hand side in the “Open Orders” section. Since that order is basically useless, I demonstrate how to cancel in the video. It is very important to triple check all orders before hitting the Place Order button. Be sure you haven’t transposed the number of coins and the price entries, or you could end up making an expensive mistake. Start slowly and progress as you become more comfortable with the process of placing trades and how they execute.

How Do CBP Orders Fill?

All orders whether Market or Limit are subject to partial fill execution. That means the total number of coins you wish to trade may be matched up to more than one corresponding order. You may get fractional fills from several orders rather than one exact match. This typically executes so quickly that the only way to tell is by reviewing your order fill report. Limit orders will fill at the specified price regardless of full or partial fills. In the rare event of very rapid price movement, it is possible that only a part of an order would fill leaving the balance on the order book. In reality this is unusual but more likely with large orders. If a buyer wishes to buy 20 bitcoins at $9,000 but Sell orders only total up to 5 bitcoins at that price before before price begins to climb, the remaining 15 bitcoins order will not execute until price declines again.

Limit orders can save you money not only on trading fees compared to Coinbase, but also allow you to set a lower entry price for your crypto purchase. However, there is no guarantee that your trade will execute, and your order could remain unfilled if prices trend continually upward. You can increase the odds that an order will execute by placing it close to current price. There may be times when you’d rather just immediately buy a coin. In those cases, you can still save big on fees by just placing a Market order.

Advanced Order Options

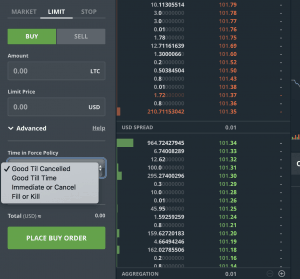

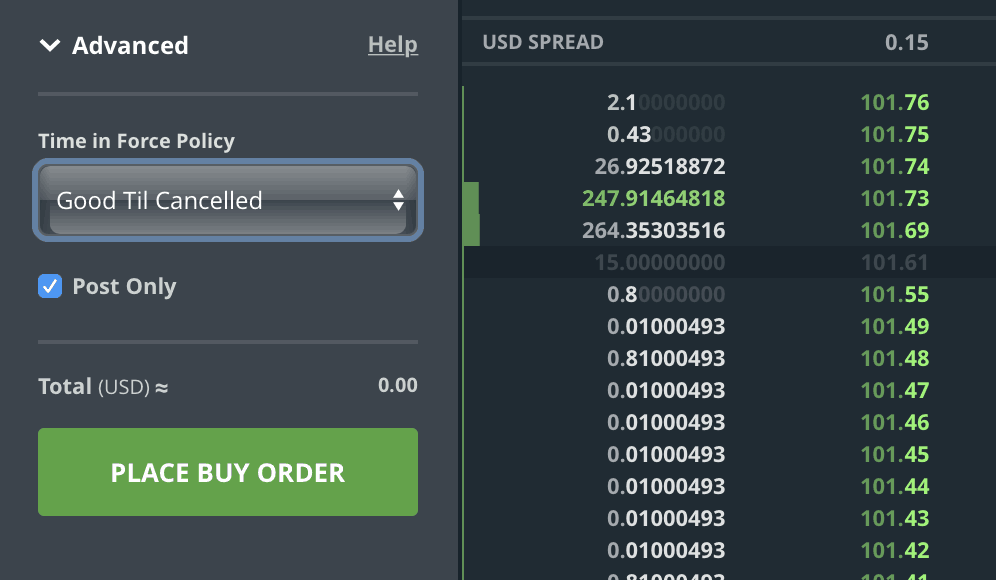

Using the Advanced option drop down menu allows you further control of order execution. The default status for Limit orders is the Good Until Canceled option. This means that the order will remain in the system until trading price matches and the order is filled. Traders can also choose to leave the order in for a specified time. The current options are for orders to remain active for one minute, one hour or 24 hours after entry. Immediate or Cancel option will execute if there are current corresponding orders at your specified price. These can be filled with partial orders by matching more than one order to your price. The Fill or Kill option can be used to force your order to immediately match up to an opposite order of exactly the same number or coins or expire if no matching orders exist. It will not execute via partial fills. These types of orders are only useful when placed near the current trading price. It would do no good to enter a Fill or Kill Buy order for BTC at $7 unless someone has accidentally entered an exact opposite trade to sell at $7.

The Post Only option can save you a little more. When Market Buy orders are entered, the buyer is considered to be the order Taker, and GDAX Taker fee schedule applies. This fee varies from 0.1-0.3% depending on coin and your daily trading volume. Here is their fee schedule page. Limit Buy orders, on the other hand, result in the buyer being the market Maker. If the Post Only selection is chosen, you can avoid being charged the Taker fee.

You can read more on GDAX order options in our companion article Entering GDAX Orders and Trades.

CBP Order Book

While navigating around the trading page, you may have also noticed the Order Book, a rapidly changing list of numbers in center of screen. Those are actual orders that have been placed by buyers and sellers. The red section shows active Sell orders. In our first video, the first column indicates how many litecoins are being sold and column 2 indicates the price specified for that sale. Note the Sell order closest to the underlying buy price is rapidly changing as portions of the order are filled. The Buy orders are shown as green. Note the large Buy order closest to the current trading price begins dropping in priority as new orders come in to Buy at a slightly higher price. The order books are always rapidly changing. This information is more important for arbitrage and day traders in my opinion. I use the order book to get an idea of where to price my entry if I’m interested in buying relatively quickly. I typically enter an order just lower than current price to save a little more compared to a Market order.

Charts and Walls on CBP

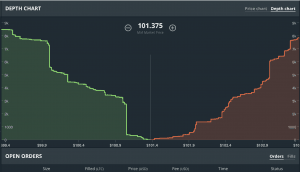

If you follow any cryptocurrency traders on YouTube or social media, it is impossible to miss their emphasis on charts. This article will not delve into Technical Analysis; the topic is beyond the scope of any beginner’s article. But it is important to at least familiarize yourself with the charting options on the trading page. There are 2 major charting tools available here: the Price chart and the Depth chart.

https://youtu.be/EVyTss0wuUM

Let’s start with the Price chart. Be sure to navigate and select Price chart near the top right of the page. You can then move directly to the left and choose either a line chart or a candle chart and also set the timeframe for that chart. This quick video cycles through some of the options for Price charts. The bar graph at the bottom indicates trading volume at each price on graph directly above. You can highlight any portion of the chart to get more information about that specific point. When you select a portion of the chart, data from that is transferred to the trade order entry boxes on the left. Make sure you clear this before placing a trade unless you want the trade to execute at that price.

Depth charts indicate the level of Buy versus Sell orders. Traders often talk about Buy and Sell “walls.” In essence, those are large orders placed at set price level which then display on the depth chart as a large vertical line, or wall, at a certain price. In order for prices to move up or down, these walls of orders must first be filled or get canceled. When watching charts, a large wall may help you determine where to place your Limit order price.

Placing Buy orders slightly higher than a wall or Sell price slightly lower probably means your trade will execute before the wall orders execute. Some price walls are possibly fake though, and this is one way some traders believe investors with large positions can push prices in a desired direction. This is hard to confirm, but it is certainly not out of the realm of possibility.

Trading on CBP via the Mobile Interface

CBP is not available via a downloaded app. However, if you navigate to their page in your phone’s browser, you will get a relatively elegant mobile interface. The following video demonstrates order entry similar to the description above for the web interface. Orientation of the phone changes the display features. I prefer the portrait (vertical) look and feel. Experiment with landscape mode if you wish. Again, tab around the options to get familiar with everything before placing your first trade. Be sure to follow the earlier paragraphs describing order entry in more detail.

https://youtu.be/Cy9vgIRZKAk

Now You’re Ready to Trade on CBP

Hopefully you are now able to place Buy and Sell orders on CBP to take advantage of very low fee structure relative to Coinbase. I’ve shown you how to place basic trades at Market Price for immediate low cost buying or selling. Placing Limit Orders allows you to take advantage of price swings for even greater savings but at the risk of not having the order fill. Once you become familiar with all of these trading options, be sure to check back here for more advanced articles to follow. I’ll leave the reader with one last caution: Always triple check the order entry options before hitting the Place Order button. Make sure you’ve set the price and amount you wish to buy or sell. Make sure you don’t transpose the number of coins and trade price. You could end up with a very expensive mistake. Take your time, enter small orders first and proceed gradually. Happy investing.