chrisbizplanner

Contributor

Crypto Market Regulation Overview and Prospects Report, Part II

This article is a continuing series of the research done by Huobi Academy of Blockchain Application, the research arm of Huobi Pro; It’s a sneak preview of the detailed report of Crypto Market Regulation Overview and Prospects Report. The in-depth information about the crypto asset market, crypto market regulation, the Blockchain industry and technology can be found in www.huobi.pro.

The year.2017 was a revolutionary year for a crypto market industry where the world embraced crypto assets and the market value. The value share increased astronomically leading to market chaos, and that led to the introduction of regulatory policies. Huobi Research summarized the entire regulatory framework based on 2016 Gross Domestic Product and mid-2018: updated related policies.

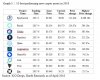

Graph 1.: Overview of crypto assets and crowdfunding policies in major countries and regions

Source: Huobi Research

In late 2017 and early 2018, several countries have formulated such additional regulations in their respective country’s financial laws. Huobi Research is emphasizing three important trends that are very key to the future.

Ø The USA has become a good regulatory norm for other countries to adopt.US SEC is an important institution assigned the role to regulate the crypto assets, enforcing licensing and taxation compliance. Other countries are expected to adopt the same approach.

Ø Both centralized regulators and self-regulatory organizations are expected to play important roles: Centralized guidance and regulation are becoming so important.

Ø Efforts to improve regulation systems by leading countries and regions will accelerate the formation of global joint regulation among member unions. The paradigm is shifting to centralized regulation and formation of global joint regulation among member unions is gaining momentum.

Huobi Research tracked the crypto blockchain market regulatory policies of major countries and regions in the world, and evaluate their regulations on four ways:

· Whether crypto assets are permitted to be used as a payment tool

· Whether crypto assets exchanges are permitted to operate

Whether investments in crypto assets are permitted

· Whether crypto assets crowdfunding is permitted

· Supervision Strictness Index (SSI) is introduced in the evaluation. The SSI varies from one to four star, which implies the more the star, the tighter the policies and the more unacceptable their attitude towards crypto assets and vice versa.

· North America

· USA: From loose to tight, SEC and other regulatory agencies are emphasizing on securities to crypto assets. SSL ***.

The USA government via its’ regulatory agency called the Internal Revenue Service (IRS) treats crypto assets as commodities instead of as currencies. It doesn’t recognize crypto asset’s monetary attributes, and the regulation doesn’t stop any merchant to accept crypto asset as a monetary tool.

Asia

Japan: The overall regulation is still very loose, the laws to crypto assets especially crowdfunding are about to be implemented. SSL: Payment Service Amendment Act was signed into law on 1at of April 2017 which recognized Bitcoin as a payment system.

South Korea: Policies have been strengthened; Anti Money Laundering(AML) is taken seriously, the main issue. SSL: *** South Korea does not have a relevant law(s) recognizing crypto asset as a monetary tool and does not prohibit any transaction.

Singapore: The overall regulation is still loose, no major change in policies, the environment is very conducive to crypto assets. Expect friendly regulation soon. SSL *. In 2014, the Inland Revenue Authority Of Singapore (IRAS) recognized crypto assets such as bitcoin as a commodity and as a non-monetary. Any transaction made using crypto assets is asset transaction, not a monetary transaction and a VAT is applied.

Hong Kong: There’s no substantial change, enforcement of the regulation is strengthened. SSI:*** Hong Kong does not have a relevant law(s) recognizing crypto asset as a monetary tool and does not prohibit any transaction. Using crypto asset such as Bitcoin.

Europe

United Kingdom: The policies towards crypto assets are unclear and no restrictions yet. SSL *

Russia: From being strict to loose, regulations turning clear and definite, SSI:***.

Switzerland:The regulation is friendly in overall, constantly improving policy, SSI:***

German: The regulatory policies relatively clear and definite, and a lot is improving, SSI: **

This is just a preview from the report of Huobi Academy of Blockchain Application, the research arm of Huobi Pro, to have access to the full report; visit www.huobi.pro and www.hadax.com.

Disclaimer: This report is for information purpose ONLY and not intended for

investment/trading advise. Investing in any crypto asset is solely your responsibility and at your discretion.

This article is a continuing series of the research done by Huobi Academy of Blockchain Application, the research arm of Huobi Pro; It’s a sneak preview of the detailed report of Crypto Market Regulation Overview and Prospects Report. The in-depth information about the crypto asset market, crypto market regulation, the Blockchain industry and technology can be found in www.huobi.pro.

The year.2017 was a revolutionary year for a crypto market industry where the world embraced crypto assets and the market value. The value share increased astronomically leading to market chaos, and that led to the introduction of regulatory policies. Huobi Research summarized the entire regulatory framework based on 2016 Gross Domestic Product and mid-2018: updated related policies.

Graph 1.: Overview of crypto assets and crowdfunding policies in major countries and regions

Source: Huobi Research

In late 2017 and early 2018, several countries have formulated such additional regulations in their respective country’s financial laws. Huobi Research is emphasizing three important trends that are very key to the future.

Ø The USA has become a good regulatory norm for other countries to adopt.US SEC is an important institution assigned the role to regulate the crypto assets, enforcing licensing and taxation compliance. Other countries are expected to adopt the same approach.

Ø Both centralized regulators and self-regulatory organizations are expected to play important roles: Centralized guidance and regulation are becoming so important.

Ø Efforts to improve regulation systems by leading countries and regions will accelerate the formation of global joint regulation among member unions. The paradigm is shifting to centralized regulation and formation of global joint regulation among member unions is gaining momentum.

Huobi Research tracked the crypto blockchain market regulatory policies of major countries and regions in the world, and evaluate their regulations on four ways:

· Whether crypto assets are permitted to be used as a payment tool

· Whether crypto assets exchanges are permitted to operate

Whether investments in crypto assets are permitted

· Whether crypto assets crowdfunding is permitted

· Supervision Strictness Index (SSI) is introduced in the evaluation. The SSI varies from one to four star, which implies the more the star, the tighter the policies and the more unacceptable their attitude towards crypto assets and vice versa.

· North America

· USA: From loose to tight, SEC and other regulatory agencies are emphasizing on securities to crypto assets. SSL ***.

The USA government via its’ regulatory agency called the Internal Revenue Service (IRS) treats crypto assets as commodities instead of as currencies. It doesn’t recognize crypto asset’s monetary attributes, and the regulation doesn’t stop any merchant to accept crypto asset as a monetary tool.

Asia

Japan: The overall regulation is still very loose, the laws to crypto assets especially crowdfunding are about to be implemented. SSL: Payment Service Amendment Act was signed into law on 1at of April 2017 which recognized Bitcoin as a payment system.

South Korea: Policies have been strengthened; Anti Money Laundering(AML) is taken seriously, the main issue. SSL: *** South Korea does not have a relevant law(s) recognizing crypto asset as a monetary tool and does not prohibit any transaction.

Singapore: The overall regulation is still loose, no major change in policies, the environment is very conducive to crypto assets. Expect friendly regulation soon. SSL *. In 2014, the Inland Revenue Authority Of Singapore (IRAS) recognized crypto assets such as bitcoin as a commodity and as a non-monetary. Any transaction made using crypto assets is asset transaction, not a monetary transaction and a VAT is applied.

Hong Kong: There’s no substantial change, enforcement of the regulation is strengthened. SSI:*** Hong Kong does not have a relevant law(s) recognizing crypto asset as a monetary tool and does not prohibit any transaction. Using crypto asset such as Bitcoin.

Europe

United Kingdom: The policies towards crypto assets are unclear and no restrictions yet. SSL *

Russia: From being strict to loose, regulations turning clear and definite, SSI:***.

Switzerland:The regulation is friendly in overall, constantly improving policy, SSI:***

German: The regulatory policies relatively clear and definite, and a lot is improving, SSI: **

This is just a preview from the report of Huobi Academy of Blockchain Application, the research arm of Huobi Pro, to have access to the full report; visit www.huobi.pro and www.hadax.com.

Disclaimer: This report is for information purpose ONLY and not intended for

investment/trading advise. Investing in any crypto asset is solely your responsibility and at your discretion.